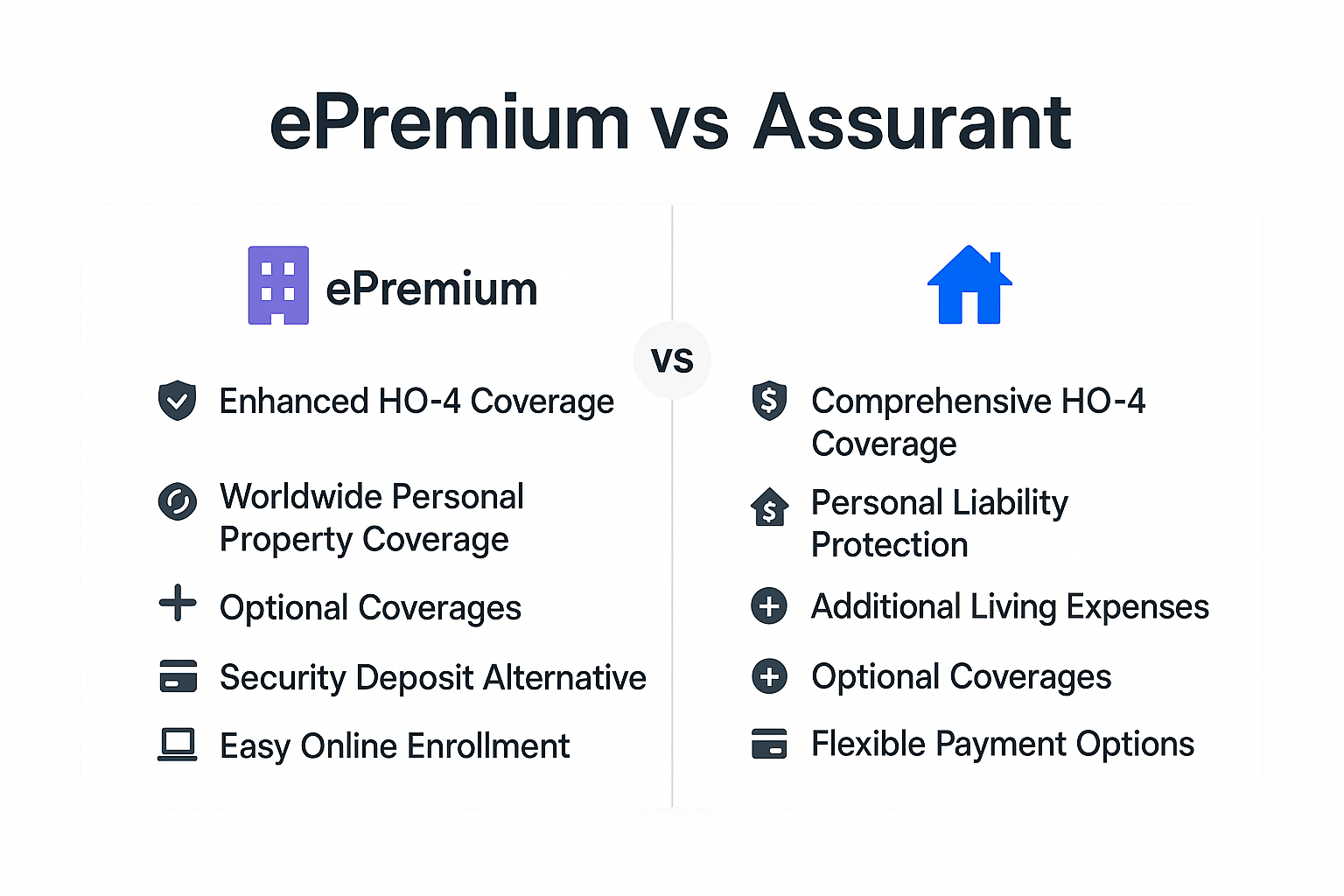

epremium Vs assurant

Check Your Local Rates Now

Compare options from multiple Insurance companies

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold.

Renters insurance is a vital safeguard for tenants, offering protection for personal belongings, liability, and additional living expenses. In 2025, ePremium and Assurant are two leading providers, each with distinct advantages and drawbacks. Here’s a detailed comparison to help you decide which is the better fit for your needs.

Overview and Company Background

ePremium

ePremium specializes in renters insurance for multifamily and single-family rentals, partnering with property managers and landlords to provide integrated solutions. The company is known for streamlined enrollment and unique coverage options, often required or recommended by property managers.

Assurant

Assurant is a national insurer offering renters insurance directly to consumers and through property management partners. The company is recognized for its broad standard coverage, customizable policies, and a strong digital presence, making it accessible to renters across the country.

Coverage Options

| Coverage Type | ePremium | Assurant |

|---|---|---|

| Personal Property | $10,000–$75,000 (replacement cost) | Replacement cost included (customizable) |

| Liability | $100,000 standard | $100,000+ (customizable) |

| Loss of Use | Included | Included |

| Medical Payments | Included | Included |

| Bedbug Remediation | Included | Included in some states |

| Pet Damage | Included | Optional add-on |

| Mold Damage | Not standard | Included |

| Roommate Coverage | Included | Add at no extra cost |

Both providers offer robust standard coverage, but Assurant stands out for including mold damage and offering replacement cost as standard. ePremium’s unique features include bedbug and pet damage coverage in most policies.

Optional Add-ons and Endorsements

ePremium:

Identity theft protection

Water/sewer backup

Earthquake (CA only)

Biohazard cleanup

Resident-caused water damage

Scheduled personal property

Assurant:

Earthquake coverage (select states)

Flood insurance

Pet damage protection

Sewer backup

Smartphone/device protection

Identity fraud expense

Unemployment insurance (rent protection)

Assurant offers a wider variety of optional add-ons, including unique options such as unemployment insurance and smartphone protection.

Pricing and Discounts

| Provider | Average Monthly Price | Discounts Available |

|---|---|---|

| ePremium | $11–$22 | Bundling, claims-free, auto-pay, pay-in-full (varies by carrier) |

| Assurant | $13–$16 | Multi-policy, claims-free, auto-pay, pay-in-full |

Assurant is generally more affordable and transparent about pricing, while ePremium’s rates can be higher and discounts depend on the underlying carrier.

Availability

ePremium: Available in all 50 states and D.C., but only through participating property managers and landlords.

Assurant: Available nationwide to all renters, regardless of landlord participation.

Claims Process and Customer Experience

ePremium:

Claims are managed by the underlying carrier. Some customers report delays and communication issues, particularly with claim payouts and support.

Assurant:

Claims can be filed online or by phone 24/7. Many customers experience fast claims turnaround, but the company receives more complaints than average, mostly about claim denials and customer service.

Customer Satisfaction and Complaints

ePremium:

Receives mixed reviews, with praise for easy enrollment and unique coverage, but criticism for higher costs and limited customization. Common complaints involve claims delays and communication breakdowns.

Assurant:

Generally receives positive feedback for coverage and value, but also sees a higher volume of complaints, particularly about claims handling and customer service responsiveness. The lack of a mobile app is a noted inconvenience for some customers.

Pros and Cons

| Provider | Pros | Cons |

|---|---|---|

| ePremium | Unique coverage (bedbug, pet damage) | Higher-than-average rates |

| Security deposit alternative | Limited policy customization | |

| Easy enrollment via property manager | Claims handled by third parties | |

| Assurant | Replacement cost included as standard | High volume of consumer complaints |

| Wide range of unique add-ons | No mobile app | |

| Roommate and pet add-ons available | Some coverage options only in select states | |

| Affordable, transparent pricing |

Who Should Choose Which?

Choose ePremium if:

Your property manager requires or recommends it.

You want built-in bedbug and pet damage protection.

You need a security deposit alternative.

Choose Assurant if:

You want more flexible coverage and add-ons.

You value affordable, transparent pricing.

You want to add roommates or pets easily.

You prefer direct-to-consumer service and online management.

Comparison Table

| Feature | ePremium | Assurant |

|---|---|---|

| Company Type | Insurance agency | National insurance provider |

| Availability | 50 states + D.C. (partner properties) | 50 states + D.C. (direct to consumer) |

| Avg. Monthly Price | $11–$22 | $13–$16 |

| Personal Property | $10,000–$75,000 | Customizable (replacement cost standard) |

| Liability | $100,000 | $100,000+ |

| Loss of Use | Included | Included |

| Bedbug Remediation | Included | Included (some states) |

| Pet Damage | Included | Optional |

| Identity Theft | Optional | Optional |

| Earthquake | Optional (CA only) | Optional (select states) |

| Flood | Not standard | Optional |

| Security Deposit Alt. | eDeposit program | Not offered |

| Discounts | Limited, varies by carrier | Multiple, transparent |

| Claims Process | Through carrier, mixed reviews | 24/7 online/phone, fast but many complaints |

| Customer Service | Mixed, some delays | Fast claims, but high complaint volume |

Conclusion

Both ePremium and Assurant offer strong renters insurance options for 2025, but they cater to different needs. ePremium is ideal for renters in property-managed communities seeking unique protections like bedbug and pet damage coverage, especially if a security deposit alternative is appealing.

Assurant is better suited for renters who want affordable, flexible coverage with a wide range of add-ons and the convenience of direct online management. Consider your property’s requirements, desired coverage features, and customer service expectations before making your decision.

Compare Insurance Quotes Instantly

Get personalized rates in minutes from trusted providers. No hidden fees or commitments.

Get Your Free QuoteLemonade vs. Nationwide

Compare two of the most popular insurance providers for coverage, pricing, and customer experience.

Compare NowProgressive Rideshare Insurance

Find out how Progressive can protect you while driving for Uber, Lyft, or other rideshare services.

Learn MoreFreeway Insurance Quote

Get a fast, free quote from Freeway Insurance and compare options for auto, home, and more.

Get a QuoteEngineers Insurance Quote

Protect your engineering career with specialized liability and professional insurance solutions.

See OptionsLoneStar Insurance

Explore LoneStar’s insurance offerings for personal and business protection in Texas and beyond.

Explore PlansUSAA Home Insurance Quote

Get a personalized home insurance quote from USAA, trusted by military families nationwide.

Get Your QuoteFrequently Asked Questions: ePremium vs. Assurant Renters Insurance

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed