Roadside assistance coverage Arizona

As an independent insurance agent in Arizona, providing valuable insights into roadside assistance coverage is essential. Given the unique driving conditions and challenges that Arizonan motorists face, reliable roadside support is paramount. In this comprehensive guide, we will explore the various facets of roadside assistance coverage tailored to the specific requirements of Arizona drivers.

From outlining the benefits and coverage details to offering practical advice on selecting the right policy, this resource aims to empower individuals with the knowledge they need to make informed decisions about their roadside protection. Whether navigating the desert highways or the urban streets, having a thorough understanding of roadside assistance can give drivers the peace of mind they deserve. Let’s delve into the intricacies of roadside assistance coverage and its significance for drivers across the diverse landscapes of Arizona.

Understanding Roadside Assistance Coverage

Roadside assistance coverage is an essential service for drivers in Arizona, providing a safety net when unexpected vehicle issues arise. This coverage typically includes various emergency services that can be invaluable when stranded due to a breakdown, flat tire, dead battery, or other common vehicle problems.

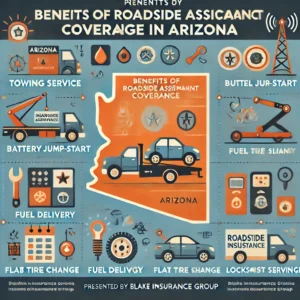

Benefits of Roadside Assistance Coverage in Arizona

– **Emergency Services**: Roadside assistance plans often cover towing, battery jump-starts, flat tire changes, fuel delivery, and lockout assistance.

Check Your Local Rates Now

Compare options from multiple Insurance companies

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold.

Customer Reviews

– **Peace of Mind**: Knowing that help is just a phone call away can provide significant peace of mind, especially when traveling through remote areas of Arizona.

– **Convenience**: Assistance is available 24/7, meaning you can get help whenever you need it, without the hassle of finding a service provider on your own.

– **Cost Savings**: The towing and other roadside services can be expensive. Roadside assistance coverage can save you money in the event of a breakdown.

– **Additional Perks**: Some plans offer extra benefits like legal defense reimbursement, guaranteed arrest bond certificates, and discounts on travel and services.

Choosing the Right Roadside Assistance Plan

As an independent insurance agent, I can guide you through Arizona’s various roadside assistance options. It’s important to consider factors such as the range of services offered, the plan’s cost, any additional benefits, and the provider’s reputation. By comparing different plans, you can find one that provides the best value and meets your specific needs as a driver in Arizona.

Choosing the right roadside assistance policy involves considering several factors, including the types of services offered, the cost, the coverage area, and any limitations or exclusions. Here’s a guide to help drivers in Arizona make an informed decision:

**Understand Your Needs**: The first step is understanding what you need from a roadside assistance plan. Consider how often you travel, the age and condition of your vehicle, and the types of situations you might need help with (e.g., flat tires, dead batteries, lockouts).

**Compare Services**: Look at the services offered by different plans. Most plans offer towing, flat tire changes, lockout service, fuel delivery, and battery jump-starts. Some also offer trip interruption coverage, which can help with expenses if you’re stranded far from home.

**Consider the Cost**: The cost of roadside assistance can vary widely, depending on the provider and the level of coverage. Be sure to compare the costs of different plans and consider whether the cost is worth the benefits you’ll receive.

**Check the Coverage Area**: Make sure the plan covers the areas where you typically drive. Some plans may only cover certain states or regions, while others offer nationwide or international coverage.

**Look at Limitations and Exclusions**: Read the fine print to understand any limitations or exclusions. For example, some plans may limit the number of service calls you can make in a year, or they may not cover certain types of vehicles or situations.

**Consider the Provider**: Finally, consider the provider’s reputation. Look for reviews or ratings online, and consider whether the provider is known for reliable service and prompt response times.

In Arizona, drivers have several options for roadside assistance, including automobile association plans (like AAA), auto insurance plans, credit card plans, automaker plans, wireless carrier plans, and independent plans. Each type of plan has pros and cons, so it’s important to compare your options and choose the one that best fits your needs.

What Does Roadside Assistance Cover?

Roadside assistance coverage is designed to help drivers when their vehicle breaks down or encounters other issues while on the road. The specific services and situations covered by roadside assistance can vary depending on the provider and the plan chosen, but there are several common elements that most plans include.

Roadside assistance coverage is designed to help drivers when their vehicle breaks down or encounters other issues while on the road. The specific services and situations covered by roadside assistance can vary depending on the provider and the plan chosen, but there are several common elements that most plans include.

Common Services Covered by Roadside Assistance

– **Towing**: If your vehicle breaks down and cannot be repaired on the spot, roadside assistance typically covers the cost of towing your car to a nearby repair facility.

– **Battery Jump-Start**: If your vehicle’s battery dies, roadside assistance can jump-start to get you back on the road.

– **Flat Tire Change**: If you get a flat tire, roadside assistance can help change it with your spare. Some plans may even cover the cost of a new tire.

– **Fuel Delivery**: Roadside assistance can deliver fuel to your location if you run out of gas. The fuel cost may or may not be included in the coverage.

– **Lockout Service**: If you lock your keys in your car, roadside assistance can help you gain entry. Some plans may also cover the cost of a locksmith if necessary.

Specific Situations Covered in Arizona

In Arizona, roadside assistance coverage can be precious due to the state’s unique driving conditions. For example, the intense heat can lead to overheating and tire blowouts, while remote areas may lack readily available services. Roadside assistance can provide crucial support in these situations, offering services such as:

– **Emergency Water Delivery**: Given the high temperatures in Arizona, some roadside assistance plans may offer emergency water delivery for both the vehicle (in case of overheating) and the driver.

– **Short Rides Off the Roadway**: If your vehicle breaks down in a dangerous location or under extreme weather conditions, roadside assistance may provide a short ride to a safer location.

– **Minor On-Site Repairs**: Some roadside assistance plans may offer minor on-site repairs that don’t require parts or supplies, helping you get back on the road without needing a tow.

Types of Roadside Assistance Plans

Roadside assistance plans can be a lifesaver when you’re stranded on the road due to a vehicle breakdown. They offer various services to help you get back on the road or to a safe location. Here are some common types of roadside assistance plans:

**Automobile Association Plans**: Organizations like the American Automobile Association (AAA) offer these. Services typically include towing, flat tire change, lockout service, fuel delivery, and battery jump-starts. Some plans also provide trip interruption coverage, which can help with expenses if you’re stranded far from home.

**Auto Insurance Plans**: Many auto insurance companies offer roadside assistance as an add-on to their standard policies. The services are similar to automobile associations, but the coverage details can vary depending on the insurer.

**Credit Card Plans**: Some credit card companies offer roadside assistance as a perk for cardholders. The services and costs can vary widely, so reading the fine print is important.

**Automaker Plans**: Many car manufacturers offer roadside assistance for new vehicles, often as part of the warranty package. These plans typically cover towing to the nearest dealership or authorized repair facility, lockout service, flat tire changes, and battery jump-starts.

**Wireless Carrier Plans**: Some mobile phone service providers offer roadside assistance as an add-on service. The coverage can vary, but it typically includes basic services like towing, flat tire changes, and lockout service.

**Independent Plans**: Some companies specialize in roadside assistance, offering a range of plans to suit different needs. These can include services like towing, flat tire changes, fuel delivery, lockout service, and more.

Each type of plan has its pros and cons, and the best choice depends on your specific needs, the reliability of your vehicle, how much you travel, and your budget. It’s important to read the terms and conditions of any plan before you sign up to ensure it provides the coverage you need.

The Arizona Department of Public Safety’s Roadside Motorist Assistance (RMA) program provides valuable services to stranded motorists throughout the state. Motorist Assistants are non-law enforcement agents who patrol Arizona’s highways in specially equipped vehicles, offering assistance to drivers in need.

Some of the services provided by the RMA program include:

– Locating and assisting stranded motorists

– Diagnosing minor vehicle problems

– Making minor repairs

– Changing tires and wheels

– Providing fuel

– Offering short rides off the roadway

– Calling tow services when necessary

In addition to these services, Motorist Assistants may also be assigned to special tasks, such as traffic control during specific events. The RMA program aims to ensure the safety and well-being of motorists on Arizona’s highways, helping them get back on the road or make safe alternative arrangements when necessary. In 2018, the program assisted 75,235 stranded motorists throughout the state.

Progressive Roadside Assistance companies Arizona

| Provider | Coverage Options | Estimated Average Cost | Customer Ratings | Additional Perks |

|---|---|---|---|---|

| AAA | Towing, battery jump-starts, fuel delivery, tire changes, lockout services | $52.50 - $116.50 per year | Mixed reviews | Discounts on travel, DMV services, passport photos, notary services, and more |

| State Farm | Towing, battery jump-starts, fuel delivery, tire changes, lockout services | $8 - $24 per year | High satisfaction | No annual limit on service calls, affordable rates |

| GEICO | Towing, battery jump-starts, fuel delivery, tire changes, lockout services | $14 per year | High satisfaction | Quick response times, GPS locator, service tracker via mobile app |

| Allstate | Towing, battery jump-starts, fuel delivery, tire changes, lockout services | $25 per year (insurance add-on) | High satisfaction | Pay-per-use options, mobile app access, trip interruption reimbursement |

| Progressive | Towing, battery jump-starts, fuel delivery, tire changes, lockout services | $16 per year | Mixed reviews | Affordable rates, but some complaints about slow response times |

Progressive Roadside Assistance is an additional coverage option that can be added to your existing Progressive auto insurance policy. It provides towing, winching, battery jump-starts, fuel delivery, electric vehicle charging, locksmith services, and flat tire changes. The coverage is available 24/7, and you can request assistance by calling 1-800-776-4737 or through Progressive’s website or mobile app.

Progressive Roadside Assistance is an additional coverage option that can be added to your existing Progressive auto insurance policy. It provides towing, winching, battery jump-starts, fuel delivery, electric vehicle charging, locksmith services, and flat tire changes. The coverage is available 24/7, and you can request assistance by calling 1-800-776-4737 or through Progressive’s website or mobile app.

The cost of Progressive Roadside Assistance is typically less than $20 per year for drivers. However, the cost may vary depending on factors such as your location and vehicle type. The coverage is available for cars, RVs, motorcycles, and boats.

Some of the benefits of Progressive Roadside Assistance include:

– Free towing for 15 miles per tow

– Jump starts

– Lockout services

– Fuel delivery

– Tire changes

– Winching/extraction

Remember that the coverage limits and services provided may vary depending on your policy and location. It’s essential to read the terms and conditions of your plan to understand the coverage limits and any potential premium increases if you call for service.

Good Sam Roadside Assistance Arizona

Good Sam Roadside Assistance offers various plans to cater to the needs of RV owners and other motorists. Some of the key benefits and coverage provided by Good Sam Roadside Assistance include:

Good Sam Roadside Assistance offers various plans to cater to the needs of RV owners and other motorists. Some of the key benefits and coverage provided by Good Sam Roadside Assistance include:

Plan Benefits and Coverage

– Towing to the nearest service center

– RV mobile mechanic dispatch

– Flat tire repair service and RV tire delivery

– Battery jump-start service

– Emergency fuel and fluids delivery

– Vehicle lockout service

– Operational and technical assistance by certified RV technicians

– Emergency medical referral service

– Discounts on repairs, rentals, hotels, and more

Cost of the Coverage

The cost of Good Sam Roadside Assistance plans varies depending on the level of coverage and the type of vehicles included. For example, the Good Sam Platinum Roadside Assistance plan costs $79.95 annually, while other plans may have different pricing.

Customer Reviews and Ratings

Good Sam Roadside Assistance has mixed reviews from customers. Some users have praised the service for its prompt assistance and helpful technicians. However, others have reported negative experiences, such as long wait times and difficulties with customer service. Reading multiple reviews and considering individual experiences when evaluating any service is essential.

Good Sam Roadside Assistance offers a range of plans and services to help RV owners and other motorists in case of emergencies on the road. The cost of coverage varies depending on the plan, and customer reviews are mixed. Researching and comparing different plans is essential to find the best fit for your needs.

Safeco roadside assistance coverage Arizona.

Safeco Roadside Assistance is an optional coverage that can be added to your existing Safeco auto insurance policy. It offers a range of services to help you in emergencies on the road. Some of the key features of Safeco Roadside Assistance include:

Safeco Roadside Assistance is an optional coverage that can be added to your existing Safeco auto insurance policy. It offers a range of services to help you in emergencies on the road. Some of the key features of Safeco Roadside Assistance include:

– Towing to a qualified facility or location within 15 miles

– Flat tire repair

– Battery jump-start service

– Fuel and fluid delivery (costs of these items not included)

– Lockout services

Safeco Roadside Assistance costs typically between $8 to $10 per year, although the exact price may vary depending on your location and the type of vehicle you drive. The coverage is available for private passenger autos, motorcycles, antique and classic cars, various RVs, and boat trailers.

In addition to the basic roadside assistance package, Safeco also offers an Emergency Assistance Package, which includes all the benefits of the basic package plus additional services such as winching for up to 100 feet from the road.

To request Safeco Roadside Assistance, call 1-877-762-3101, use the Safeco mobile app, or visit the Safeco website. The service is available 24 hours a day, 365 days a year.

AAA Roadside Assistance Coverage Arizona

AAA Roadside Assistance is a service provided to AAA members that offers help in emergencies on the road. The coverage includes a range of services, such as:

AAA Roadside Assistance is a service provided to AAA members that offers help in emergencies on the road. The coverage includes a range of services, such as:

– Towing up to a certain distance (depending on the membership level)

– Battery jump-start service

– Flat tire change

– Fuel delivery (free for Plus and Premier members, while Basic members pay for the fuel)

– Lockout assistance

– Winching (for Plus and Premier members)

AAA offers different membership levels, such as Basic, Plus, and Premier, with varying benefits and coverage limits. The cost of AAA roadside assistance generally ranges from $29 to $65 per year, depending on the membership level.

To request AAA Roadside Assistance, call 1-800-AAA-HELP (1-800-222-4357), use the AAA mobile app, or visit the AAA website. The service is available 24/7, and your AAA membership covers you as a driver or passenger in any eligible vehicle.

In addition to roadside assistance, AAA membership provides discounts and deals at various shops, restaurants, hotels, movie tickets, and more.

Frequently Asked Questions about Roadside Assistance in Arizona

What types of roadside assistance services are available in Arizona?

Roadside assistance services in Arizona typically include towing, battery jump-starts, fuel delivery, tire changes, and lockout services. Some providers also offer additional services like winching, emergency medical referrals, and trip interruption assistance.

How much does roadside assistance cost in Arizona?

The cost of roadside assistance in Arizona varies by provider. For example, AAA charges between $52.50 and $116.50 per year, State Farm charges $8 to $24 per year, GEICO charges $14 per year, and Progressive charges $16 per year.

Can I get roadside assistance for my RV in Arizona?

Yes, several providers offer roadside assistance for RVs in Arizona. Good Sam Roadside Assistance, for instance, specializes in RV services and provides comprehensive coverage, including towing to the nearest capable service center and emergency medical referrals.

What should I do if I need roadside assistance in a remote area of Arizona?

Providers like Good Sam and Encore Protection have extensive networks to ensure help is available if you need roadside assistance in a remote area. Good Sam has a network of over 40,000 service and repair facilities across the U.S. and Canada. At the same time, Encore Protection uses a dispatch system to locate and send the nearest qualified service provider.

Are there any additional benefits offered by roadside assistance providers in Arizona?

Yes, many roadside assistance providers offer additional benefits. For example, Good Sam provides trip interruption assistance, concierge services, and emergency medical referrals. Encore Protection discounts hotels and shopping, and Verizon provides satellite-based assistance for iPhone users in non-coverage areas.

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: [email protected]

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed