dwelling fire insurance

Protecting your dwelling with the right insurance coverage is one of the most important investments you can make as a property owner. At Blake Insurance Group, we understand that your property is more than just a building—it’s a valuable asset that deserves comprehensive protection. That’s why we specialize in offering tailored dwelling fire insurance policies to safeguard your rental properties, vacation homes, and secondary residences.

Protecting your dwelling with the right insurance coverage is one of the most important investments you can make as a property owner. At Blake Insurance Group, we understand that your property is more than just a building—it’s a valuable asset that deserves comprehensive protection. That’s why we specialize in offering tailored dwelling fire insurance policies to safeguard your rental properties, vacation homes, and secondary residences.

Dwelling fire insurance is a specialized coverage explicitly designed for non-owner-occupied properties. Unlike traditional homeowners insurance, which covers your primary residence and personal belongings, dwelling fire insurance focuses solely on protecting the physical structure of your rental, seasonal, or vacant property.

Whether you own a cozy cabin in the mountains, a beachfront getaway, or a multi-unit rental complex, the proper dwelling fire insurance policy can provide you with the peace of mind you deserve. By working closely with our experienced agents, you can protect your property against various perils, including fire, lightning, explosions, and more.

At Blake Insurance Group, we pride ourselves on our personalized approach to insurance. We take the time to understand your unique needs and tailor a policy that fits your specific situation. From choosing the appropriate coverage limits to adding valuable endorsements like loss of rental income protection, our agents will guide you through the process, ensuring that you have the right coverage.

In the following sections, we’ll explore dwelling fire insurance in more detail, exploring the different types of policies available, the perils covered, and the benefits of having this essential coverage. We’ll also address common misconceptions and provide real-life scenarios illustrating the importance of properly insuring.

Protecting your property is our top priority, and we’re here to help you navigate the complexities of dwelling fire insurance. Contact us today to schedule a consultation and take the first step toward securing your valuable investment.

Types of Properties Covered

Dwelling fire insurance is designed to cover various types of properties that are not the owner’s primary residence. Here are the common types of properties that can be covered under a dwelling fire insurance policy:

Dwelling fire insurance is designed to cover various types of properties that are not the owner’s primary residence. Here are the common types of properties that can be covered under a dwelling fire insurance policy:

Rental Properties

Dwelling fire insurance is ideal for landlords who own rental properties, whether a single-family home, a multi-unit apartment building, or a condominium. This policy protects the physical structure of the rental property against covered perils, safeguarding the landlord’s investment.

Vacation Homes

If you own a vacation home or a second home, that you only occupy for a portion of the year, a dwelling fire insurance policy can provide the necessary coverage. These properties are often left unoccupied for extended periods, making them more susceptible to risks like fire, vandalism, or weather-related damage.

Vacant Homes

Dwelling fire insurance is an excellent option for temporarily vacant homes, whether due to renovation, relocation, or other circumstances. These policies cover vacant properties, which may not qualify for standard homeowners insurance coverage.

Seasonal Homes

Dwelling fire insurance can provide the appropriate level of protection for properties that are only occupied during certain seasons, such as a summer cottage or a winter ski chalet. These policies can be tailored to accommodate the unique needs of seasonal properties.

Secondary Residences

If you own a secondary residence that is not your primary dwelling, a dwelling fire insurance policy can provide comprehensive coverage for the structure. This could include a secondary home used for personal or rental purposes, protecting your investment against covered perils.

It’s important to note that dwelling fire insurance policies typically cover the property’s physical structure and may include limited coverage for personal belongings or appliances owned by the landlord or property owner. However, they do not provide liability coverage or protection for the personal possessions of tenants or occupants.

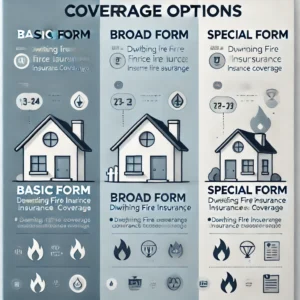

Coverage Options

When it comes to dwelling fire insurance, there are three main forms or levels of coverage available: Basic Form (DP-1), Broad Form (DP-2), and Special Form (DP-3). Each form offers a different level of protection, allowing you to choose the coverage that best suits your needs and budget.

When it comes to dwelling fire insurance, there are three main forms or levels of coverage available: Basic Form (DP-1), Broad Form (DP-2), and Special Form (DP-3). Each form offers a different level of protection, allowing you to choose the coverage that best suits your needs and budget.

Basic Form (DP-1)

The DP-1 policy is the most basic form of dwelling fire insurance. It is a “named perils” policy, which covers losses caused by specific perils explicitly listed in the policy. Typically, the DP-1 form covers losses due to:

– Fire

– Lightning

– Internal explosions (such as from a stove or water heater)

Additionally, you can add optional endorsements to a DP-1 policy to provide coverage against vandalism and malicious mischief and extended coverage for perils like windstorms, hail, smoke, and volcanic eruptions.

Claims under a DP-1 policy are typically settled on an actual cash value (ACV) basis, which means the payout is based on the property’s depreciated value at the time of the loss. However, you may have the option to purchase a replacement cost value (RCV) endorsement for an additional premium.

Broad Form (DP-2)

The DP-2 policy, also known as the Broad Form, provides more comprehensive coverage than the Basic Form. Like the DP-1, it is a “named perils” policy, but it covers a broader range of perils, including:

– All perils covered by the DP-1 form

– Extended coverage perils (e.g., windstorms, hail, smoke)

– Vandalism and malicious mischief

– Burglary damage

– Weight of ice and snow

– Glass breakage (if the building was not vacant for 60+ days)

– Accidental discharge or overflow of water or steam (if the building was not vacant for 60+ days)

– Falling objects (e.g., trees)

– Freezing of pipes

– Electrical damage

– Collapse due to decay, vermin, or insect damage

– Tearing apart, cracking, burning, or bulging

Unlike the DP-1 form, claims under a DP-2 policy are typically settled on a replacement cost basis, which means you’ll receive the full cost to repair or replace the damaged property without deducting for depreciation.

Special Form (DP-3)

The DP-3 policy, or the Special Form, is the most comprehensive dwelling fire insurance coverage available. It is an “open perils” or “all-risk” policy, which means it covers all types of damage to the dwelling and other structures except for the exclusions listed explicitly in the policy.

Typical exclusions in a DP-3 policy may include:

– War

– Water damage

– Laws and ordinances

– Neglect

– Intentional loss

– Mold, rust, rot, and other gradual losses

– Certain types of water damage

– Earth movement (e.g., earthquakes)

It’s important to note that while the DP-3 form provides open perils coverage for the dwelling and other structures, personal property (contents inside the dwelling) is covered on a “named perils” basis.

The key differences between these forms lie in the scope of coverage and the settlement basis for claims. The DP-1 offers the most basic coverage, while the DP-2 and DP-3 provide progressively broader protection, with the DP-3 being the most comprehensive option.

Comparing Dwelling Fire Insurance to Homeowners Insurance

While dwelling fire insurance and homeowners insurance both provide coverage for residential properties, there are some key differences between the two types of policies:

Key Differences

**Coverage Scope**: Homeowners insurance is a comprehensive policy that covers the dwelling structure, personal belongings, personal liability, and additional living expenses. In contrast, dwelling fire insurance primarily covers the property’s physical structure and may have limited coverage for personal belongings or liability.

**Occupancy**: Homeowners insurance is designed for properties that are the policyholder’s primary residence. On the other hand, Dwelling fire insurance is intended for non-owner-occupied properties, such as rental homes, vacation homes, or secondary residences.

**Perils Covered**: Homeowners insurance typically provides “all-risk” coverage, which covers all perils except those explicitly excluded in the policy. Dwelling fire insurance policies can vary, with some offering “named perils” coverage (covering only specified perils like fire, lightning, and explosions) and others providing broader “open perils” coverage.

**Personal Property Coverage**: Homeowners insurance covers personal belongings and contents within the home. Dwelling fire insurance policies may offer limited or no coverage for personal property, as the primary focus is on the physical structure.

**Liability Protection**: Homeowners insurance includes personal liability coverage, which protects the policyholder from legal and medical expenses if someone is injured on their property. Dwelling fire insurance policies typically do not include liability coverage as a standard feature, although endorsements can add it.

Situations Where Dwelling Fire Insurance is More Appropriate

Dwelling fire insurance is more suitable in the following situations:

**Rental Properties**: If you own a property that you rent out to tenants, dwelling fire insurance is the appropriate coverage to protect your investment property.

**Vacation Homes**: For vacation homes or secondary residences that are not your primary dwelling, dwelling fire insurance can provide the necessary coverage while you are away.

**Vacant Properties**: If a property is vacant due to being for sale or undergoing renovations, dwelling fire insurance can provide coverage when a standard homeowners policy may not apply.

**Investment Properties**: Dwelling fire insurance is a suitable option for properties that are part of your real estate investment portfolio and not occupied by you or your family.

**High-Risk Areas**: In areas prone to wildfires or other high-risk situations, dwelling fire insurance may be required when homeowners insurance is difficult to obtain or excludes certain perils.

| Feature | Dwelling Fire Insurance | Homeowners Insurance |

|---|---|---|

| Primary Use | Non-owner-occupied properties (e.g., rental properties, vacation homes, vacant homes) | Owner-occupied primary residences |

| Coverage Scope | Primarily covers the physical structure of the property and attached structures | Comprehensive coverage including the dwelling, personal property, liability, and additional living expenses |

| Perils Covered | Varies by policy form (DP-1, DP-2, DP-3); DP-1 covers named perils, DP-2 covers more named perils, DP-3 covers open perils except for exclusions | Typically covers all perils except those explicitly excluded (open perils) |

| Personal Property Coverage | Limited or optional; not automatically included | Included by default, covering personal belongings inside the home |

| Liability Coverage | Optional; can be added as an endorsement | Included by default, providing personal liability protection |

| Loss of Use Coverage | Optional; can be added as an endorsement | Included by default, covering additional living expenses if the home is uninhabitable |

| Loss of Rental Income | Available as an endorsement (e.g., DP-3 includes fair rental value coverage) | Not typically included, as it is designed for owner-occupied homes |

| Policy Forms | DP-1 (Basic Form), DP-2 (Broad Form), DP-3 (Special Form) | HO-3 (Special Form) is the most common form |

| Settlement Basis | DP-1: Actual Cash Value (ACV); DP-2 and DP-3: Replacement Cost Value (RCV) | Replacement Cost Value (RCV) for both the dwelling and personal property |

| Typical Exclusions | Varies by policy form; common exclusions include war, water damage, neglect, and earth movement | Varies by policy; common exclusions include flood, earthquake, and intentional damage |

| Cost | Generally lower premiums due to more limited coverage | Higher premiums due to comprehensive coverage |

Cost Considerations

The average cost of dwelling fire insurance typically ranges from $1,500 to $3,000 per year. However, the actual premium can vary significantly depending on several factors. Here are some key considerations that affect the premiums for dwelling fire insurance policies:

Factors Affecting Premiums

**Location**: The property’s geographic location plays a crucial role in determining premiums. Areas prone to natural disasters like hurricanes, earthquakes, or wildfires tend to have higher insurance costs due to the increased risk.

**Property Value**: The insured value of the dwelling, which is typically based on the replacement cost, is a major factor in calculating premiums. Higher-valued properties generally have higher premiums.

**Age and Condition of the Property**: Older homes or properties in poor condition may be considered higher risks, resulting in higher premiums. Insurers may require inspections for older properties.

**Construction Type**: The materials used in the dwelling’s construction can impact the premium. For example, properties built with fire-resistant materials like brick or concrete may qualify for lower rates.

**Occupancy Type**: Whether the property is a rental, vacation home, or vacant can influence the premium. Vacant properties are often considered higher risks and may have higher premiums.

**Coverage Level**: The cost will be affected by the type of dwelling fire policy form (DP-1, DP-2, or DP-3) and the extent of coverage chosen. More comprehensive policies like DP-3 typically have higher premiums.

**Deductible Amount**: Choosing a higher deductible can lower the premium, as the policyholder assumes more of the initial risk.

**Claims History**: Properties with previous claims may be subject to higher premiums, as insurers view them as higher risks.

| State | Estimated Average Annual Cost |

|---|---|

| Arizona | $1,800 |

| Alabama | $2,400 |

| Florida | $3,500 |

| Georgia | $2,200 |

| New Mexico | $1,700 |

| New York | $2,000 |

| North Carolina | $2,100 |

| Oklahoma | $3,000 |

| Texas | $2,600 |

| Virginia | $1,900 |

How to Get Premium Credits for Renovations and Repairs

Many insurers offer premium credits or discounts for homeowners who take proactive measures to reduce the risk of potential losses. These can include:

**Updating Electrical, Plumbing, or Heating Systems**: Replacing outdated systems with modern, code-compliant systems can qualify for premium credits, as it reduces the risk of fires or water damage.

**Installing Security Systems**: Installing burglar alarms, fire alarms, or other security systems can often lead to discounts on premiums.

**Roof Replacement**: Replacing an old roof with a new, impact-resistant roof can sometimes result in premium credits, as it reduces the risk of damage from storms or falling objects.

**Renovations or Repairs**: Completing renovations or repairs that bring the property up to current building codes and improve its overall condition can potentially qualify for lower premiums.

Discuss any renovations, repairs, or safety upgrades with your insurance provider, as they may be eligible for premium credits or discounts. Documentation and proof of the improvements can help you receive the appropriate rate adjustments.

Dwelling Fire Insurance FAQs

Blake Insurance Group

Phone: (888) 387-3687

Email: [email protected]

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464