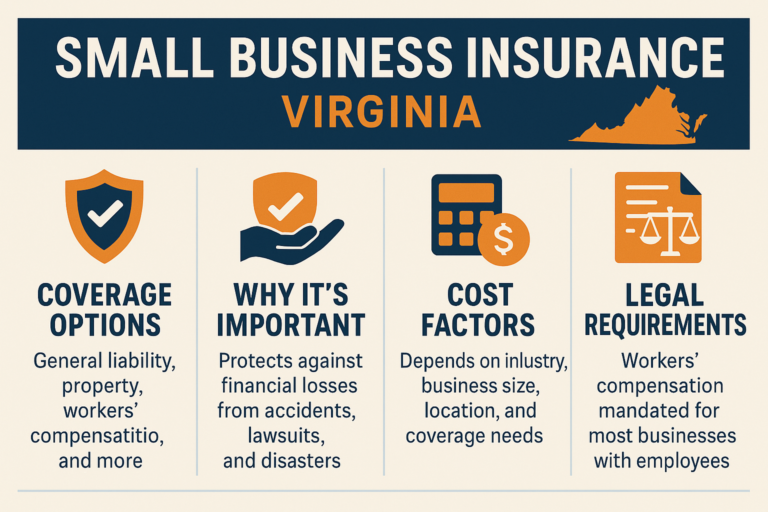

small business insurance Virginia

Virginia Business Insurance and Workers’ Comp Requirements

Virginia offers a vibrant economy for businesses, from tech companies in Northern Virginia to tourism and service industries along the coast.

However, no matter your industry, it’s crucial to understand Virginia’s business insurance requirements to protect your company and remain legally compliant.

Here’s your complete guide to Virginia business insurance and workers’ compensation rules.

Small Business Insurance Calculator

Get a Business Insurance Quote

Protect your business in minutes. Fast, flexible, affordable coverage from Thimble.

Start Your QuoteInstant quotes. No long forms. No commitment.

Who Needs Business Insurance in Virginia?

While Virginia does not require all businesses to carry general liability insurance by law, several types of insurance are mandatory based on business operations.

You likely need business insurance in Virginia if:

You have employees

You operate vehicles for business purposes

You offer professional services or consulting

You rent or own a commercial property

You are signing leases or contracts that require proof of insurance

Even when not legally required, business insurance provides essential protection against lawsuits, property loss, and other costly risks.

Workers’ Comp: When It’s Required

In Virginia, workers’ compensation insurance is required if you:

Regularly employ two or more employees (full-time, part-time, seasonal, or family members).

Key facts:

Sole proprietors with no employees are exempt.

If you hire subcontractors, they may count toward your employee total for workers’ comp requirements.

Coverage must be purchased from a private insurance carrier or through self-insurance (if qualified).

Workers’ compensation insurance covers medical bills, lost wages, and rehabilitation expenses for employees who suffer job-related injuries or illnesses.

Failing to carry workers’ comp can lead to fines of up to $250 per day, capped at $50,000.

Commercial Auto Insurance Basics

If your business owns vehicles or uses them for work, commercial auto insurance is required by Virginia law.

Minimum commercial auto coverage requirements:

$30,000 bodily injury per person

$60,000 bodily injury per accident

$20,000 property damage

Important:

Personal auto policies do not cover vehicles used for business purposes. Businesses should also consider Hired and Non-Owned Auto Insurance (HNOA) if employees use personal vehicles for business tasks.

Professional Liability for Certain Jobs

Professional liability insurance (also called Errors and Omissions insurance) is not required by Virginia state law for all businesses.

However, it is often required by industry regulations, licensing boards, or client contracts, especially for:

Lawyers and law firms

Real estate agents and brokers

Healthcare providers (separate malpractice insurance)

Accountants and CPAs

Architects and engineers

Consultants and IT professionals

Professional liability insurance protects your business against claims of negligence, errors, or failure to deliver services properly — even if claims are baseless.

Is General Liability Insurance Mandatory?

General liability insurance is not required statewide in Virginia, but it is strongly recommended and often becomes mandatory through contracts or leasing agreements.

You may be required to carry general liability insurance if:

You rent commercial space

You apply for certain professional or contractor licenses

You work with municipalities, government contracts, or large corporations

You provide services directly to customers

General liability insurance covers third-party bodily injury, property damage, personal injury (libel/slander), and associated legal defense costs.

Other Useful Coverages for Virginia Businesses

Beyond the basics, many Virginia businesses can benefit from additional protections:

Commercial Property Insurance: Covers your building, inventory, and equipment against fire, theft, vandalism, and some weather events.

Business Owner’s Policy (BOP): Bundles general liability and commercial property insurance into a single, cost-effective policy for small to mid-sized businesses.

Cyber Liability Insurance: Essential for businesses that store customer data, manage online transactions, or are vulnerable to data breaches.

Employment Practices Liability Insurance (EPLI): Protects against lawsuits filed by employees alleging discrimination, harassment, wrongful termination, and more.

Flood Insurance: Important for businesses near rivers, the coast, or other flood-prone areas (standard property policies typically exclude flood coverage).

Product Liability Insurance: Important for manufacturers, retailers, and distributors facing risk from defective products.

Summary Table: Virginia Business Insurance Requirements

| Insurance Type | Required by Law? | Who Needs It? | Typical Minimums/Notes |

|---|---|---|---|

| Workers' Compensation | Yes (2+ employees) | Employers with two or more employees | Covers workplace injuries and illnesses |

| Commercial Auto Insurance | Yes (for business-owned vehicles) | Businesses operating vehicles for work | $30k/$60k/$20k liability minimums |

| General Liability Insurance | No (but often required by contracts/leases) | Contractors, service providers, retail, leasing | Common for leases, licensing, and government contracts |

| Professional Liability (E&O) | No (except required for certain professions) | Lawyers, consultants, healthcare, engineers | Covers errors, negligence, or professional service failures |

| Commercial Property Insurance | No | Businesses with physical locations or assets | Protects against fire, theft, vandalism, some natural disasters |

| Business Owner’s Policy (BOP) | No | Small to mid-sized businesses | Combines general liability and property into a discounted policy |

| Cyber Liability Insurance | No | Businesses handling sensitive digital data | Covers data breaches, cyberattacks, and customer notifications |

| Employment Practices Liability (EPLI) | No | Businesses with employees | Covers discrimination, wrongful termination, and harassment claims |

| Flood Insurance | No (but critical in many areas) | Businesses in flood zones | Required separately; not included in standard property coverage |

| Product Liability Insurance | No | Manufacturers, distributors, product sellers | Covers liability for defective or unsafe products |

In summary: Virginia businesses must comply with workers’ comp and commercial auto insurance requirements, while general liability and professional liability insurance are essential for risk management and often required by contracts or leasing agreements. Additional coverages like BOP, property, cyber, and flood insurance help protect against Virginia’s diverse business risks.

Virginia Business Insurance: Frequently Asked Questions (FAQs)

What types of business insurance are required in Virginia?

Virginia law requires most businesses with two or more employees (including part-time, seasonal, and family members) to carry workers’ compensation insurance. If your business owns or uses vehicles for work, you must have commercial auto insurance that meets state minimum coverage limits.

How many employees trigger the workers’ compensation requirement?

If you have two or more employees (including part-time, temporary, or family members), you are required to carry workers’ compensation insurance in Virginia.

What are the minimum commercial auto insurance requirements in Virginia?

As of 2025, the minimum limits are $50,000 bodily injury per person, $100,000 bodily injury per accident, and $25,000 property damage per accident.

Is general liability insurance mandatory in Virginia?

General liability insurance is not required by Virginia law for most businesses, but it is strongly recommended. Some industries or contracts (such as construction or licensing boards) may require it.

What other types of business insurance are recommended?

Business Owner’s Policy (BOP): Bundles general liability and property insurance.

Professional Liability (E&O): For businesses providing professional services or advice.

Cyber Liability: For businesses handling sensitive customer data.

Commercial Property Insurance: Protects your physical assets.

Umbrella Insurance: Extends liability coverage beyond policy limits.

How much does business insurance cost in Virginia?

Average monthly costs (2025 estimates):

General liability: $40

Workers’ compensation: $42

Professional liability/E&O: $78

BOP: $41–$80, depending on business type and size.

How do I get a certificate of insurance in Virginia?

After purchasing your policy, you can request a certificate of insurance from your insurer or agent, which serves as proof of coverage for clients, landlords, or licensing boards.

Can I use a personal auto policy for business vehicles?

No. Personal auto insurance does not cover business use. You need a commercial auto policy or hired and non-owned auto insurance (HNOA) if you use personal, leased, or rented vehicles for work purposes.

Are there industry-specific insurance requirements in Virginia?

Yes. Certain professions (like doctors, contractors, or real estate agents) may be required to carry specific types of insurance, such as malpractice or contractor liability.

How do I file a complaint or get help with business insurance in Virginia?

Contact the Virginia State Corporation Commission’s Bureau of Insurance at 1-877-310-6560 or visit their website for support.

What should I consider when shopping for business insurance?

Compare coverage options and premiums from multiple licensed insurers. Check the licensing status of agents and companies. Understand policy exclusions and consider endorsements for additional protection. Keep good records and an inventory of business assets for claims.

Where can I learn more about Virginia business insurance requirements?

The State Corporation Commission’s Bureau of Insurance and reputable insurance providers offer guides and FAQs for Virginia business owners.

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464