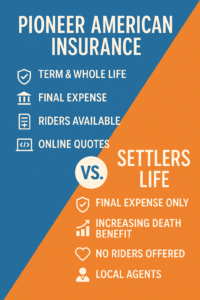

Pioneer American Insurance vs Settlers Life

Affordable life insurance is essential for families and seniors seeking peace of mind without breaking the bank. Pioneer American Insurance and Settlers Life are two established providers, each with unique strengths in the final expense and whole life insurance markets. Here’s how they stack up across the areas that matter most.

Life Insurance Calculator

Customer Reviews

Company Overviews

Pioneer American Insurance

Founded in 1961 and based in Texas, Pioneer American is part of the American-Amicable Group. The company offers a range of life insurance products, including term, whole, and universal life, and is known for its flexible underwriting and focus on senior markets.

Settlers Life

Settlers Life, established in 1933 and now a subsidiary of National Guardian Life (NGL), specializes in final expense whole life insurance. While Settlers Life no longer writes new business policies as of 2018, it remains a recognized name for existing policyholders and those seeking final expense coverage in the secondary market.

Financial Strength & Ratings

| Company | A.M. Best Rating | Parent Company/Group | Financial Size Category |

|---|---|---|---|

| Pioneer American | A (Excellent) | American-Amicable / IA American | VIII ($100M–$250M) |

| Settlers Life | A- (Excellent) | National Guardian Life (NGL) | $250M–$500M |

Policy Types Offered

| Policy Type | Pioneer American | Settlers Life |

|---|---|---|

| Term Life | Yes (10–30 years) | No |

| Whole Life | Yes (up to $35,000–$50,000) | Yes (up to $50,000) |

| Universal Life | Yes (up to $250,000+, with no exam) | No |

| Final Expense | Yes | Yes |

Coverage Options & Flexibility

Pioneer American:

Term: $25,000–$250,000 (no medical exam, health questions apply)

Whole Life: Up to $35,000–$50,000, immediate or modified death benefit (waiting period for higher risk)

Universal Life: Up to $250,000 (no exam) or unlimited (with full underwriting); flexible death benefit and premiums

Convertible term options available

Settlers Life:

Whole Life: $1,000–$50,000, various plans (immediate or modified benefit)

Payment options: Single pay, 10/20-year pay, or lifetime pay

No term or universal life options

Settlers Life specializes in small, permanent policies with flexible payment structures, ideal for final expenses.

Underwriting & Application Process

Pioneer American:

Simplified issue for most products (no medical exam, but health questions required)

Generous underwriting for seniors and those with health conditions (e.g., PTSD, depression, overweight)

Modified whole life for higher-risk applicants (2-year waiting period)

Quick application process, often under 10 minutes

Settlers Life:

Simplified issue whole life (no exam, health questions)

Immediate or modified benefit plans based on health

No new policies since 2018; existing policyholders only

Both companies use simplified underwriting, but Pioneer American is more lenient for complex health profiles.

Pricing & Affordability

Pioneer American:

Competitive, though sometimes slightly higher than peers like Fidelity or Americo

Sample rates for $10,000 final expense:

50-year-old male: ~$41/month

60-year-old male: ~$59/month

Female rates are lower

Term life for a 45-year-old male: $19/month ($100,000), $38/month ($250,000)

Settlers Life:

Pricing generally competitive for final expense, but current new rates unavailable due to no new business

Historically, rates were in line with other final expense providers

Pioneer American may cost a few dollars more, but offers broader approval for those with health issues.

Alternatives to Consider

AIG: Guaranteed issue final expense, competitive rates, no health questions, but graded death benefit

Mutual of Omaha: Popular for seniors, broader market share, strong reputation, lower complaint ratio

Great Western, Americo, Fidelity: Other strong final expense insurers with varying underwriting and pricing50

Riders & Customization

Pioneer American:

Included: Terminal illness accelerated death benefit, confined care accelerated benefit

Optional: Accidental death, grandchild rider, nursing home waiver, children’s insurance agreement

Premium waiver if confined to a nursing home for 90+ days

Settlers Life:

Included: Accelerated benefit rider (terminal illness/nursing home)

Optional: Accidental death, children’s/grandchildren’s rider

No-cost child/grandchild benefit on some plans

Both offer a range of riders, but Pioneer American’s options are more extensive.

Best For…

| Company | Best For |

|---|---|

| Pioneer American | Seniors with health issues, term/universal seekers, veterans |

| Settlers Life | Final expense buyers, existing policyholders, fixed premium shoppers |

Pros and Cons

| Company | Pros | Cons |

|---|---|---|

| Pioneer American | Broad coverage options, lenient underwriting, strong financials | Slightly higher premiums, more complaints than average |

| Settlers Life | Easy to understand plans, flexible payment terms | No new policies, limited products, outdated web experience |

Customer Experience & Support

Pioneer American:

BBB accredited, A+ rating

Online claims portal, live chat, document upload, responsive service

More complaints than similarly sized competitors

Settlers Life:

Not BBB accredited, but parent NGL has A+ BBB rating

24/7 email claims reporting

Some recent complaints about customer service accessibility

No new policies since 2018; support focused on existing customers

Final Verdict

Pioneer American Insurance is a strong choice for clients seeking affordable, flexible life insurance-especially those with health conditions or in need of term or universal coverage. Their generous underwriting and customizable riders make them a standout for seniors and those who might otherwise struggle to get approved.

Settlers Life remains a reliable option for existing policyholders and those with legacy final expense whole life policies, offering solid financial backing and flexible payment options. However, with no new policies being issued, new applicants must look elsewhere for coverage.

Bottom Line:

For new buyers seeking affordable, accessible coverage-especially if you have health issues-Pioneer American is the better choice. For those already with Settlers Life, you can expect continued support and a financially stable parent company, but new applicants should consider alternatives like Pioneer American, Mutual of Omaha, or AIG for fresh policies.

Frequently Asked Questions (FAQs)

What types of life insurance does Pioneer American offer?

Pioneer American provides term life (10–30 years), whole life (up to $35,000), and universal life insurance (up to $250,000 without a medical exam for seniors).

Do I need a medical exam to qualify?

Most policies are simplified issue and do not require a medical exam, but there are health questions on the application. Some policies for higher coverage amounts may require a medical exam.

Can seniors with health issues qualify?

Yes, Pioneer American is known for lenient underwriting, often approving applicants with conditions like depression, PTSD, or being overweight. Many seniors can qualify for immediate death benefit coverage.

What is a modified whole life policy?

This is a policy for applicants with more serious health issues. It usually has a two-year waiting period before the full death benefit is paid for non-accidental death.

How flexible are Pioneer American’s policies?

Universal life policies allow you to adjust premiums and death benefits as your needs change, and term policies can be converted to permanent coverage.

What types of policies does Settlers Life offer?

Settlers Life specializes in whole life insurance, including immediate and modified benefit options with varying coverage amounts and age ranges.

Are there different payment options?

Yes, you can pay in a single payment, over 10 or 20 years, or for life. This flexibility helps fit different budgets.

Can I pay my policy online?

Yes, Settlers Life offers an online payment portal for easy and secure payments.

What riders are available?

Policyholders can add riders such as accidental death, children’s rider, and an accelerated benefit rider for additional flexibility and coverage.

How long does it take to receive a life insurance payout?

Beneficiaries typically receive the death benefit within 30 to 60 days after filing a claim, though this can vary based on circumstances.

What happens if a beneficiary does not claim the policy?

If unclaimed, benefits may be held in trust or escheated to the state, depending on policy terms and state laws.

How long do you have to file a claim after death?

Generally, claims should be filed within 1 to 2 years after the insured’s death, but check the policy for specific deadlines.

Can you access your life insurance while alive?

Whole life and universal life policies may allow access to cash value through loans or withdrawals while the policyholder is still living.

Is Settlers Life still issuing new policies?

Settlers Life is no longer issuing new policies as of 2018, but existing policyholders continue to receive support and service.

These FAQs address the most common concerns for clients considering affordable life insurance with Pioneer American or Settlers Life.

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464