Lemonade vs Progressive renters

Lemonade vs. Progressive Renters Insurance 2025

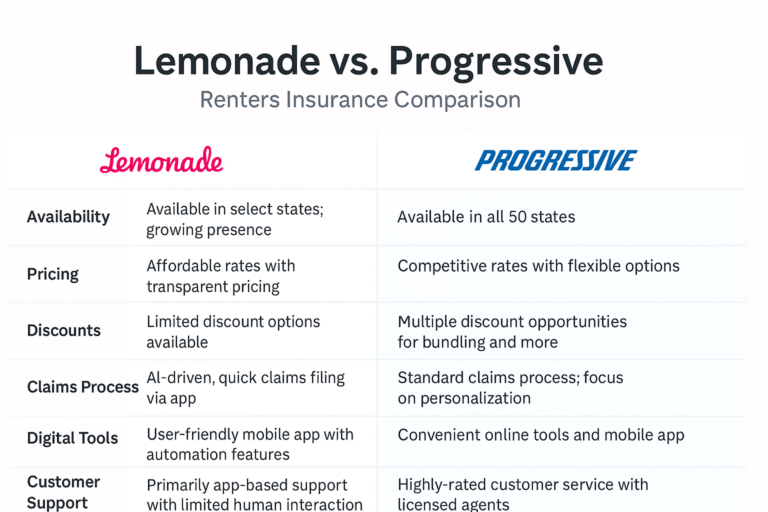

When it comes to renters insurance, two prominent names stand out in the market: Lemonade and Progressive. Both companies offer unique features tailored to different renter needs, from budget-friendly options to comprehensive coverage. This comparison will delve into key aspects such as company background, coverage options, pricing, and customer satisfaction to help renters make an informed decision.

START FREE ONLINE QUOTE NOW

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold

Lemonade

Founded in 2015, Lemonade is a tech-driven insurance company that leverages artificial intelligence to streamline the insurance process. Their digital-first approach allows customers to manage policies and file claims entirely through their app or website. A distinctive feature of Lemonade is its “Giveback” program, where unclaimed premiums are donated to charities chosen by policyholders.

Progressive

Established in 1937, Progressive is one of the largest insurance providers in the U.S., known for its extensive range of insurance products. While Progressive offers renters insurance, it’s important to note that these policies are often underwritten by third-party companies like Homesite. This structure can sometimes lead to complexities in policy management and claims processing.

Coverage Options

Lemonade

Lemonade’s standard renters insurance policy includes:

Personal Property Coverage

Personal Liability Protection

Loss of Use (Additional Living Expenses)

Medical Payments to Others

Their policies are customizable, allowing policyholders to adjust coverage limits and add endorsements as needed.

Progressive

Progressive’s renters insurance policies typically offer:

Personal Property Coverage

Personal Liability Protection

Loss of Use

Medical Payments to Others

Given that Progressive’s renters insurance is often provided through third-party underwriters, coverage details may vary, making it essential for customers to review their specific policy documents.

Optional Add-ons and Endorsements

Lemonade

Lemonade offers several optional coverages to enhance their standard policy:

Extra Coverage for high-value items like jewelry and electronics

Water Backup Protection

Equipment Breakdown Coverage

Earthquake Coverage (in select states)

Pet Damage Liability (in some states)

Progressive

Progressive provides optional coverages such as:

Water Backup Coverage

Personal Injury Protection

Identity Theft Protection

However, the availability of these endorsements can depend on the third-party underwriter providing the policy.

Pricing and Discounts

Lemonade

Lemonade’s renters insurance policies start at $5 per month, with the average cost around $16 per month nationally. In Arizona, rates range between $10 and $15 per month. They offer discounts for bundling with other Lemonade products, such as pet or car insurance.

Progressive

Progressive’s renters insurance averages about $13 per month nationally. They provide various discounts, including:

Multi-policy discount when bundling with auto insurance

Discounts for quoting in advance

Discounts for paying the policy in full

Paperless billing discounts

Availability

Lemonade

As of 2025, Lemonade’s renters insurance is available in 29 states and Washington, D.C. It’s essential to check their website to confirm availability in your specific location.

Progressive

Progressive offers renters insurance nationwide, including all 50 states and Washington, D.C., making it widely accessible to renters across the country.

Claims Process and Customer Experience

Lemonade

Lemonade utilizes an AI-driven claims process, with approximately 40% of claims settled instantly through their app. This streamlined approach is ideal for straightforward claims, though more complex cases may require additional time and human intervention.

Progressive

Progressive’s claims process can be less straightforward due to the involvement of third-party underwriters. Policyholders may need to contact the specific underwriter directly to file a claim, which can lead to confusion and potential delays.

Customer Satisfaction and Complaints

Lemonade

While Lemonade offers a modern, user-friendly experience, it has received a higher number of complaints than expected for a company of its size, according to the National Association of Insurance Commissioners (NAIC).

Progressive

Progressive has a J.D. Power customer satisfaction score of 3.72 out of 5, indicating average performance. However, some customers have reported challenges with the claims process, particularly when dealing with third-party underwriters.

Pros and Cons

Lemonade

Pros:

Affordable premiums starting at $5/month

User-friendly digital platform

Fast claims processing with AI technology

Charitable “Giveback” program

Cons:

Limited availability across states

Higher-than-average complaint ratio

Limited discount options

Progressive

Pros:

Nationwide availability

Multiple discount opportunities

Cons:

Claims process can be complex due to third-party underwriters

Customer service experiences may vary

Who Should Choose Which?

Choose Lemonade if:

You prefer a fully digital insurance experience

You’re tech-savvy and value quick, app-based claims processing

You want to support charitable causes through your insurance provider

Choose Progressive if:

You reside in a state where Lemonade isn’t available

You’re looking to bundle renters insurance with other policies like auto insurance

You prefer dealing with a well-established insurance provider with nationwide reach

Lemonade vs Progressive Renters Insurance Comparison Table (2025)

| Feature | Lemonade | Progressive |

|---|---|---|

| Founded | 2015 | 1937 |

| Availability | 29 states + D.C. | All 50 states + D.C. |

| Starting Premium | $5/month | ~$13/month |

| Average Premium | $16/month | ~$13/month |

| Standard Coverages | Personal property, liability, loss of use, medical payments | Personal property, liability, loss of use, medical payments |

| Optional Coverages | Extra coverage, water backup, equipment breakdown, earthquake (select states), pet damage liability (some states) | Water backup, personal injury protection, identity theft protection |

| Discounts | Bundling with other Lemonade policies | Multi-policy, early quote, pay-in-full, paperless billing |

| Claims Process | AI-driven, app-based, ~40% instant settlements | Varies; may involve third-party underwriters |

| Customer Satisfaction | Higher-than-average complaints | Average satisfaction; some claim process concerns |

| Best For | Tech-savvy users seeking quick, digital service | Customers looking for bundling options and nationwide availability |

Summary: Both Lemonade and Progressive offer valuable renters insurance options in 2025. Your decision should be based on digital convenience, coverage needs, bundling potential, and claim service expectations.

Compare Insurance Quotes Instantly

Get personalized rates in minutes from trusted providers. No hidden fees or commitments.

Get Your Free QuoteLemonade vs. Progressive Renters Insurance 2025: FAQs

How much does Lemonade renters insurance cost?

Lemonade offers renters insurance starting as low as $5 per month, though your actual rate will depend on your location, coverage limits, and deductible choices.

How much does Progressive renters insurance cost?

Progressive’s renters insurance typically starts at about $1 a day (around $19–$30 per month), with the national average premium being $19 per month for $30,000 in personal property coverage and $100,000 in liability coverage.

How do I get a quote and buy a policy?

Lemonade: 100% digital via website or app. Progressive: Online, by phone, or with an agent after entering your ZIP and desired coverage.

What does renters insurance from Lemonade cover?

Lemonade includes personal property, liability, loss of use, and medical payments. Optional extra coverage is available for valuables.

What does renters insurance from Progressive cover?

Progressive includes personal property, liability, loss of use, and medical payments. Optional add-ons include water backup and scheduled items.

Are there optional coverages or endorsements?

Lemonade: Extra coverage, water backup, equipment breakdown. Progressive: Water backup, personal injury, scheduled item endorsements.

Can I bundle renters insurance with other policies?

Lemonade has limited bundling features. Progressive offers strong bundling with auto, motorcycle, and other policies.

Is renters insurance available in all states?

Lemonade: 29 states + D.C. Progressive: All 50 states + D.C.

How do I file a claim?

Lemonade: File via app or website. Progressive: File online, by phone, or as a guest with proof like photos and receipts.

Can I add roommates or family members to my policy?

Lemonade: Spouses and immediate family can be added. Roommates need their own policy. Progressive: Only named individuals are covered.

What factors affect my renters insurance premium?

Both companies consider ZIP code, coverage amounts, deductible, credit, claims history, and safety features.

Can I pay my premiums automatically?

Yes. Both Lemonade and Progressive allow automatic payments.

How do I cancel my policy?

Lemonade: Cancel via app/website with prorated refund. Progressive: Cancel through service or agent; refund may apply.

Does renters insurance cover flood damage?

No. Separate flood insurance is required.

What are the main differences between Lemonade and Progressive renters insurance?

Lemonade is tech-first, low-cost, app-based, and limited in availability. Progressive is traditional, broad in coverage, and supports bundling.

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed