Lemonade vs Assurant

Check Your Local Rates Now

Compare options from multiple Insurance companies

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold.

🏡 Lemonade vs. Assurant Renters Insurance 2025

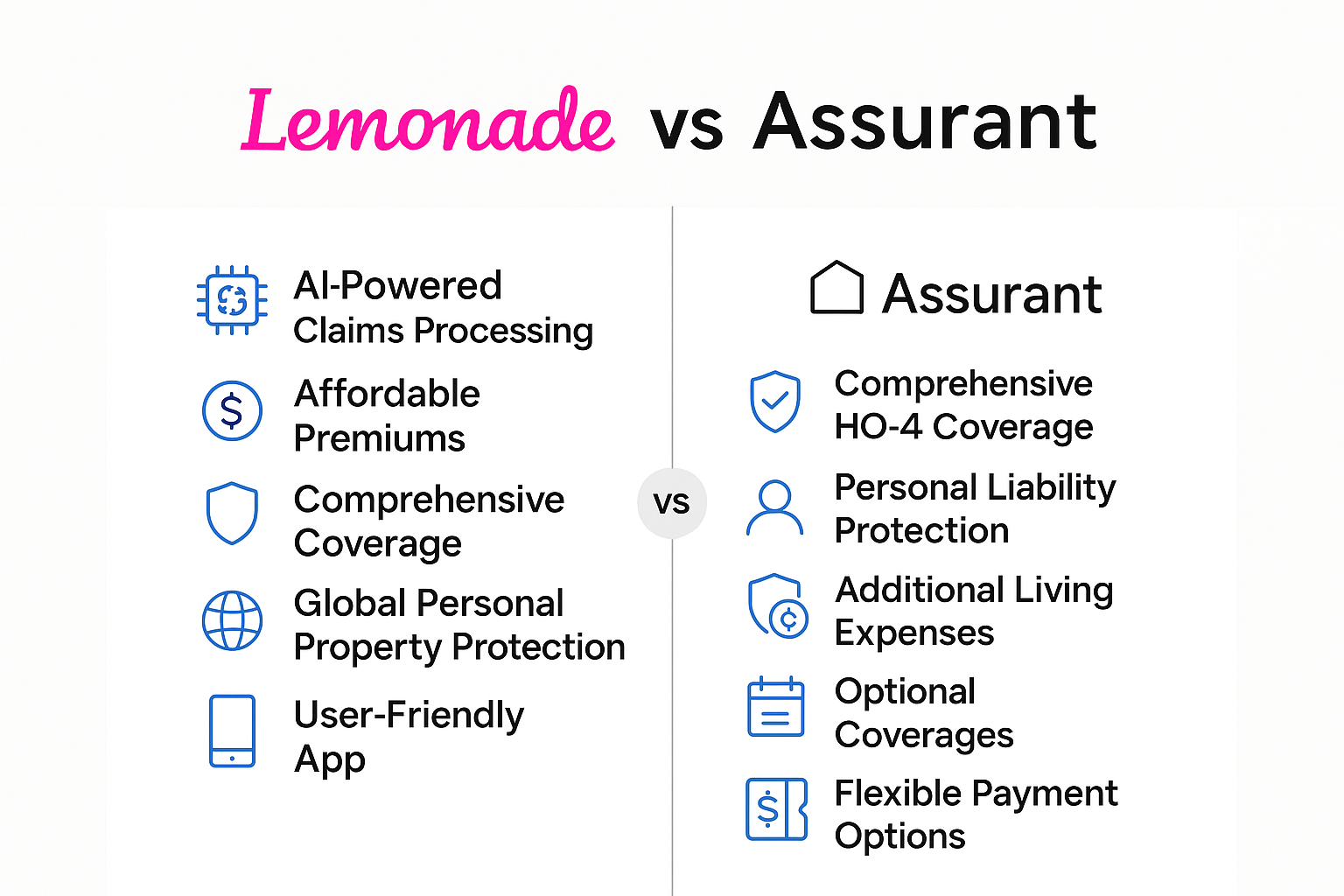

Renters today demand insurance options that are affordable, flexible, and easy to manage online. Two popular providers—Lemonade and Assurant—offer very different experiences. While Lemonade is a tech-forward disruptor with AI-driven claims and a giveback program, Assurant is a longstanding, traditional insurer with wide availability and customizable options.

This guide compares both companies across coverage, pricing, customer service, and more to help you decide which is right for your needs in 2025.

🔍 Overview and Company Background

Lemonade

Founded in 2015, Lemonade is a Public Benefit Corporation known for using artificial intelligence and behavioral economics.

It’s certified as a B-Corp and donates leftover premiums to nonprofits.

Policies are underwritten by Lemonade Insurance Company.

Assurant

Established in 1892, Assurant is a Fortune 500 insurer with a strong focus on renters, especially in multifamily housing.

Known for integrating with property management systems and offering diverse insurance products.

📋 Coverage Options

Lemonade

Personal property coverage

Personal liability

Loss of use (Additional Living Expenses)

Medical payments to others

Replacement cost included by default

Assurant

Personal property coverage

Liability protection

Loss of use

Medical payments

Optional replacement cost

➕ Optional Add-ons and Endorsements

Lemonade

Extra Coverage (for valuables like jewelry, cameras, and bikes)

Water backup

Equipment breakdown

Landlord property damage (for tenant-caused damage)

Assurant

Flood coverage

Earthquake protection (in applicable states)

Bedbug remediation

Pet damage

Food spoilage

Unemployment insurance (optional in some states)

💵 Pricing and Discounts

Lemonade

Pricing starts around $5/month, average ranges from $8–$15

Premiums calculated using AI with lower operational costs

Bundling discounts for pet or term life insurance

No agent commissions

Assurant

Average pricing $13–$16/month, depending on location

Available discounts for claims-free, pay-in-full, and bundling with other Assurant policies

Slightly more expensive but more customizable

🌐 Availability

Lemonade

Available in most U.S. states and expanding

Policies are digital-first, purchased and managed via app or website

Assurant

Available in all 50 states

Strong relationships with landlords and property managers

Traditional and digital access

🧾 Claims Process and Customer Experience

Lemonade

Fast AI-driven claim processing (many settled in seconds)

App-based interface

24/7 digital access

Some complex claims still require manual review

Assurant

Claims can be filed online, by phone, or through property manager portals

Manual review process—slower but thorough

Real-time texting support and 24/7 phone availability

😊 Customer Satisfaction and Complaints

Lemonade

Highly rated app and user experience

A+ BBB rating but some concerns with denied claims

NPS (Net Promoter Score) is above industry average

Assurant

A+ BBB rating

More complaints related to delays and customer service

Strong presence in regulated housing communities

✅ Pros and Cons

Lemonade Pros

✔️ Fast, AI-powered claims

✔️ Competitive pricing

✔️ Socially conscious business model

✔️ Seamless mobile experience

Lemonade Cons

❌ Limited human interaction

❌ Less customization

❌ Some states not yet supported

Assurant Pros

✔️ Extensive add-ons and endorsements

✔️ Available nationwide

✔️ Works directly with landlords and property managers

Assurant Cons

❌ Slower claims process

❌ Higher premiums

❌ More customer complaints about responsiveness

🎯 Who Should Choose Which?

Choose Lemonade if you…

Want quick digital claims with no paperwork

Prefer a modern app experience

Are looking for affordability and transparency

Support companies with a social mission

Choose Assurant if you…

Need pet damage or flood insurance

Want a company familiar with working through property managers

Prefer a broader set of optional coverages

Need renters insurance in a state where Lemonade isn’t available

📊 Comparison Table

| Feature | Lemonade | Assurant |

|---|---|---|

| Founded | 2015 | 1892 |

| Monthly Premium | $8–$15 | $13–$16 |

| Coverage Options | Property, liability, loss of use | Same + higher-end options |

| Extra Coverage/Add-ons | Jewelry, water backup, pet damage | Flood, pet damage, food spoilage |

| Claims Process | Instant via app, AI-based | Manual, real-time texting, 24/7 phone |

| Customer Support | App and chatbot | Online, phone, property manager portal |

| BBB Rating | A+ | A+ |

| Availability | Most U.S. states | All 50 states |

| Bundling Options | Pet & life insurance | Renters + other Assurant products |

| Best For | Tech-savvy renters, quick claims | Traditional coverage, landlord integration |

Compare Insurance Quotes Instantly

Get personalized rates in minutes from trusted providers. No hidden fees or commitments.

Get Your Free QuoteAuto Insurance Florida

Explore affordable auto insurance options tailored for Florida drivers and get your personalized quote today.

Get a QuoteSafeco Insurance Agent Near Me

Find a trusted Safeco insurance agent in your area for personal, home, and auto coverage solutions.

Find an AgentThe Hartford Commercial Insurance

Protect your business with a commercial insurance quote from The Hartford, tailored to your industry needs.

See OptionsFlood Insurance North Carolina

Get flood insurance quotes for North Carolina and safeguard your property from unexpected water damage.

Get ProtectedProgressive Insurance Claims Kansas

Learn how to file and manage Progressive insurance claims in Kansas for quick and efficient service.

File a ClaimProgressive Insurance Agent Arizona

Connect with a Progressive insurance agent in Arizona for personalized auto, home, and business coverage.

Contact AgentFrequently Asked Questions: Lemonade vs. Assurant Renters Insurance

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed