epremium Vs erenterplan

Check Your Local Rates Now

Compare options from multiple Insurance companies

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold.

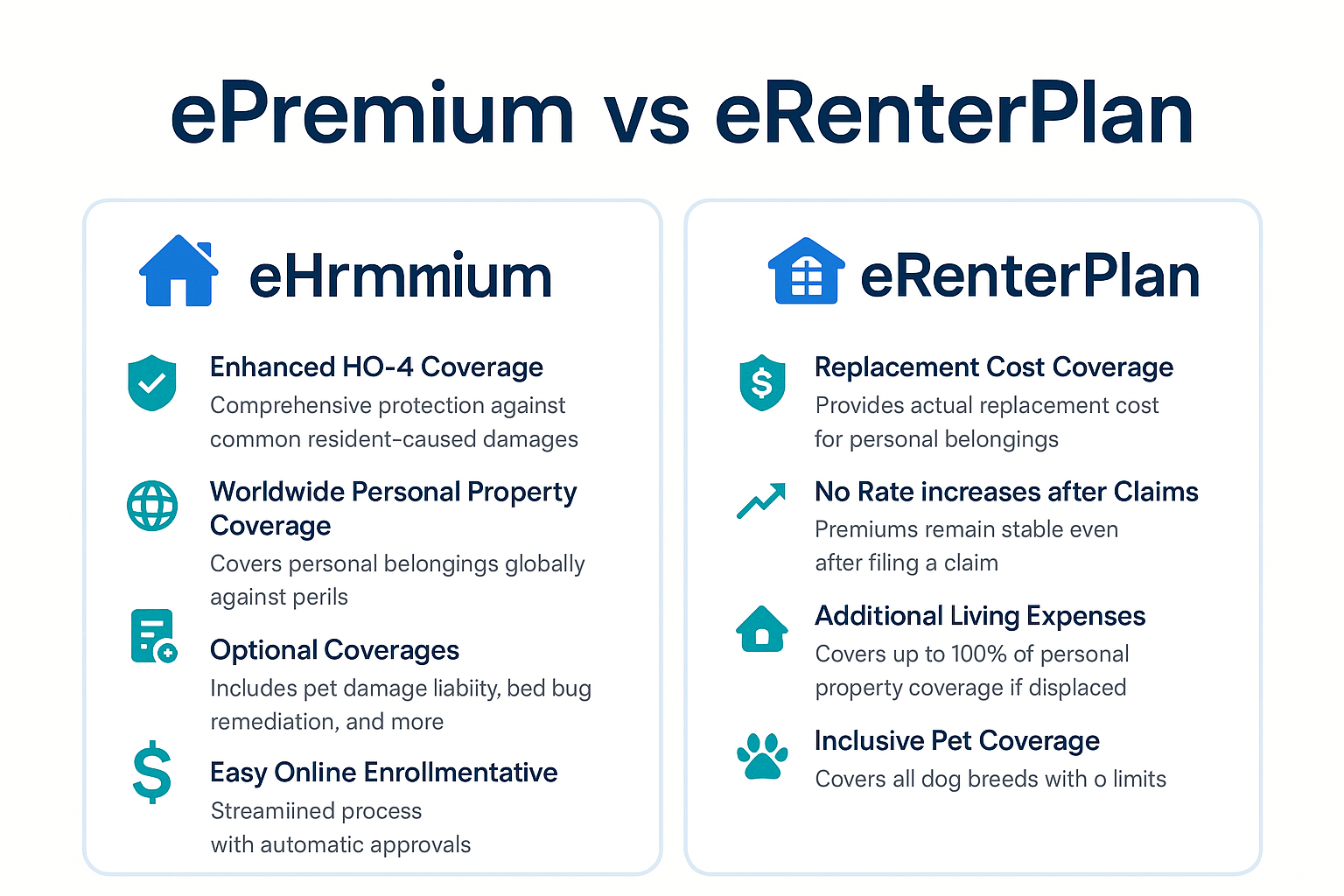

Renters insurance is an essential protection for tenants, safeguarding personal belongings, providing liability coverage, and covering additional living expenses in the event of a loss. Two major providers in this space, especially for those renting from property-managed communities, are ePremium and eRenterPlan. Both are frequently offered or required by landlords, but they have distinct features and service experiences. Here’s a detailed comparison for 2025.

Overview and Company Background

ePremium

ePremium is a specialty insurance agency that partners with property managers across the country to provide renters insurance and alternatives to traditional security deposits. The company focuses on enhanced coverage and compliance solutions for both multifamily and single-family rentals, serving a large base of renters.

eRenterPlan

eRenterPlan is a renters insurance program distributed by LeasingDesk Insurance Services and underwritten by various national insurers. The program is available exclusively through participating landlords and property managers, making it a common requirement for many apartment residents.

Coverage Options

| Coverage Type | ePremium | eRenterPlan |

|---|---|---|

| Personal Property | $10,000–$75,000 (replacement cost) | Up to $30,000 (replacement cost) |

| Liability | $100,000 (standard) | $100,000 (standard) |

| Medical Payments | Included | Included |

| Loss of Use | Included | Up to 100% of property coverage |

| Roommates | Included | Up to 4 included |

| Pet Damage | Included | Included (all breeds) |

Both providers offer standard protections for belongings, liability, and loss of use. Each includes pet damage liability, and eRenterPlan allows coverage for up to four roommates at no extra charge.

Optional Add-ons and Endorsements

ePremium:

Bed bug remediation

Biohazard cleanup

Identity theft protection (up to $5,000)

Water backup

Earthquake coverage (varies by state)

Resident-caused water damage

eRenterPlan:

Increased jewelry theft limits

Water backup coverage

Identity recovery

Unemployment rent assistance

Bedbug remediation

Hurricane deductible reduction

Earthquake protection

Both companies offer a variety of optional coverages, but ePremium includes some unique enhancements such as bed bug remediation and pet damage in its standard policy.

Pricing and Discounts

| Feature | ePremium | eRenterPlan |

|---|---|---|

| Average Monthly Cost | $11–$22 | $15–$29 |

| Discounts | Pay-in-full, minimal | Rare, occasional promotions |

| Credit Check | Not required | Not specified |

ePremium is generally more affordable, especially for those with limited credit, and offers minimal discounts. eRenterPlan tends to be more expensive and does not frequently offer discounts.

Availability

ePremium: Licensed in all 50 states and D.C., but typically only available through partner properties.

eRenterPlan: Available nationwide, but only if your property manager or landlord participates.

Claims Process and Customer Experience

ePremium:

Claims are filed by phone, with adjusters usually assigned within 72 business hours. Customer service is available on weekdays, but there are reports of communication issues and delays in claim resolution.

eRenterPlan:

Claims are handled by the underwriting insurance company, not LeasingDesk directly. Customer reviews frequently mention poor customer service, difficulty reaching representatives, and slow claims processing.

Customer Satisfaction and Complaints

ePremium:

Common complaints include miscommunication about policy status, difficulties with document uploads, and delays in claims or refunds. While some issues are resolved, many renters report frustration with customer service and billing errors. Overall satisfaction is mixed, with some appreciating the easy enrollment but others dissatisfied with support and flexibility.

eRenterPlan:

Receives low ratings for customer service, slow refunds, and complicated cancellation processes. Many complaints focus on difficulties in reaching support and resolving claims. Customers often feel the company is unresponsive and inflexible, especially regarding refunds or policy changes.

Pros and Cons

| Provider | Pros | Cons |

|---|---|---|

| ePremium | – No credit check | – Limited customization |

| – Enhanced standard coverage (pet, bed bug, etc.) | – Minimal discounts | |

| – Security deposit alternative (eDeposit) | – Some customer service complaints | |

| eRenterPlan | – Covers high-risk dog breeds | – Only available through participating properties |

| – Roommate and pet coverage included | – Higher premiums, few discounts | |

| – Replacement cost coverage standard | – Low coverage limits, poor customer service |

Who Should Choose Which?

Choose ePremium if:

You have poor credit or want a quick, no-credit-check policy.

You value enhanced standard protections (pet damage, bed bug remediation).

Your property manager offers it and you want a security deposit alternative.

Choose eRenterPlan if:

Your landlord requires it.

You need roommate or pet coverage included by default.

You are willing to pay a bit more for a policy that’s easy to obtain through your property manager.

ePremium vs eRenterPlan Renters Insurance 2025

| Feature | ePremium | eRenterPlan |

|---|---|---|

| Availability | Nationwide (except Alaska) | All 50 states (participating properties) |

| Average Monthly Premium | $11–$22 | $15–$20 (some reports up to $29) |

| Credit Check Required | No | Varies by underwriting insurer |

| Mobile App | No | No |

| Optional Coverages | Pet damage, bedbug remediation, etc. | Unemployment rent protection, earthquake, etc. |

| Customer Satisfaction | High (4.89/5 J.D. Power) | Varies; some insurers have high complaint ratios |

| Discounts | Limited | None advertised |

| Claims Process | Through ePremium | Through underwriting insurer |

Both ePremium and eRenterPlan are solid choices for renters who need to meet property manager requirements, but they differ in cost, flexibility, and customer experience. ePremium stands out for its enhanced standard coverage and lower cost, especially for those with limited credit, while eRenterPlan is often chosen for its ease of enrollment and included roommate/pet options.

However, both have room for improvement in customer service and claims handling. Renters should consider their specific needs, property requirements, and willingness to accept limited flexibility before choosing either provider.

Compare Insurance Quotes Instantly

Get personalized rates in minutes from trusted providers. No hidden fees or commitments.

Get Your Free QuoteUmbrella Insurance

Extra liability protection that goes beyond your auto or home policy limits—ideal for added peace of mind.

Learn MoreAllstate Home Insurance Quote

Compare Allstate home insurance rates and coverage options to protect your property and belongings.

Get a QuoteFlood Insurance in California

Protect your home from water damage not covered by standard homeowners insurance. Essential in flood zones.

View OptionsCleveland Insurance Brokers

Explore top-rated insurance brokers in Cleveland, Ohio. Local help for auto, home, life, and more.

Find BrokersProgressive Insurance in Alabama

Get Alabama-specific coverage with Progressive. Local agents ready to assist with auto, home, and business policies.

Explore CoverageTraders Auto Insurance Reviews

See what real customers say about Traders Auto Insurance—affordability, claims, and customer service ratings.

Read ReviewsFAQs for ePremium vs. eRenterPlan Renters Insurance

- What is the difference between ePremium and eRenterPlan renters insurance?

- ePremium is an insurance agency that partners with property managers to offer renters insurance and security deposit alternatives, often with enhanced standard coverage and no credit check. eRenterPlan is a renters insurance program offered through LeasingDesk, available only via participating landlords, and is known for its included roommate and pet coverage.

- Which renters insurance is more affordable: ePremium or eRenterPlan?

- ePremium generally offers lower average monthly premiums ($11–$22) compared to eRenterPlan ($15–$29), making it more affordable for many renters, especially those with limited credit.

- Does ePremium require a credit check?

- No, ePremium policies do not require a credit check, making them accessible for renters regardless of credit history.

- Are pets covered under ePremium and eRenterPlan policies?

- Yes, both ePremium and eRenterPlan include pet damage liability in their standard policies. eRenterPlan also covers all dog breeds.

- Can I get ePremium or eRenterPlan if my landlord does not participate?

- No, both ePremium and eRenterPlan are only available to renters whose property managers or landlords participate in their programs.

- What coverage limits are available with ePremium and eRenterPlan?

- ePremium offers personal property coverage from $10,000 to $75,000, while eRenterPlan offers up to $30,000. Both provide standard liability coverage of $100,000.

- How does the claims process compare between ePremium and eRenterPlan?

- ePremium claims are filed by phone, with adjusters typically assigned within 72 business hours. eRenterPlan claims are handled by the underwriting insurance company, often with reports of slower response times and more difficulty reaching representatives.

- Are roommates covered under both policies?

- Yes, ePremium includes roommate coverage, and eRenterPlan covers up to four roommates at no extra cost.

- What unique add-ons are available with each provider?

- ePremium offers add-ons like bed bug remediation, biohazard cleanup, identity theft protection, and security deposit alternatives. eRenterPlan offers options such as increased jewelry theft limits, unemployment rent assistance, hurricane deductible reduction, and earthquake protection.

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed