small business insurance Alabama

Alabama Business Insurance and Workers’ Comp Requirements

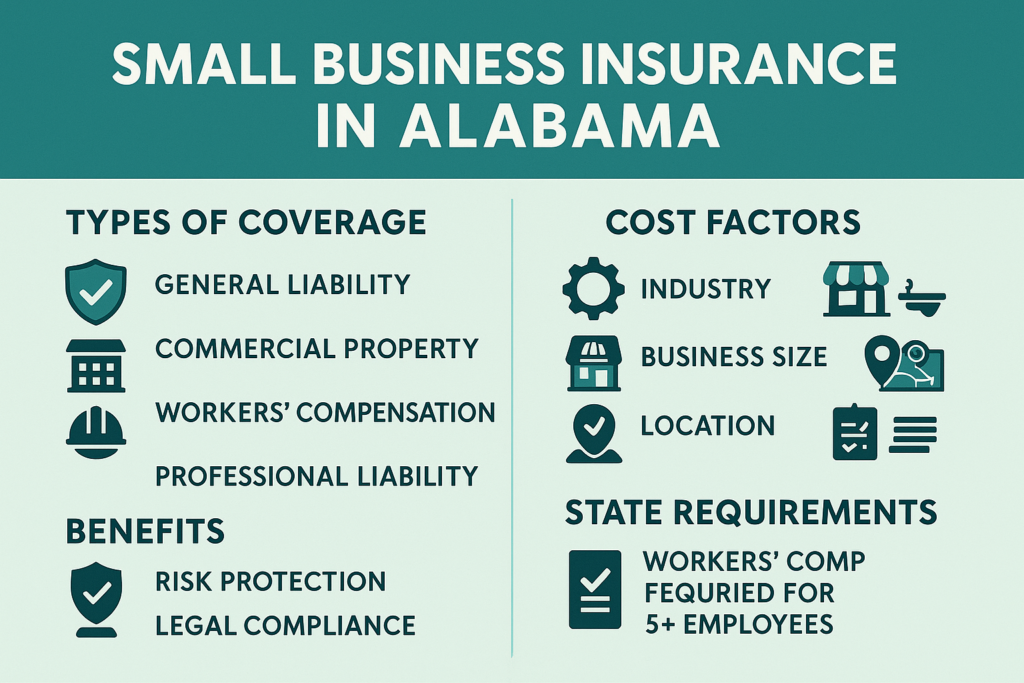

Alabama business owners must navigate a combination of state-mandated insurance requirements and industry best practices to protect their companies, employees, and assets. Here’s what you need to know to stay compliant and secure.

Small Business Insurance Calculator

Get a Business Insurance Quote

Protect your business in minutes. Fast, flexible, affordable coverage from Thimble.

Start Your QuoteInstant quotes. No long forms. No commitment.

Who Needs Business Insurance in Alabama?

Employers with Five or More Employees: Alabama law requires businesses with five or more full-time or part-time employees (including corporate officers and LLC members) to carry workers’ compensation insurance.

Businesses That Own Vehicles: Any Alabama business that owns, leases, or operates vehicles for business purposes must have commercial auto insurance.

Professionals Offering Services: Professions such as healthcare, legal, financial, architectural, engineering, and consulting services should consider professional liability insurance, which may be required by licensing boards or client contracts.

Home Inspectors: Alabama requires home inspectors to carry both general liability and errors & omissions (E&O) insurance to maintain an active license.

All Other Businesses: While not all insurance types are mandated by law, most businesses benefit from carrying general liability, property, and other coverages to protect against lawsuits, property damage, and operational risks.

Workers’ Comp: When It’s Required

Mandatory for Five or More Employees: Alabama requires all employers with five or more employees to provide workers’ compensation insurance, covering both full-time and part-time staff.

Exemptions: Domestic workers, farm laborers, casual employees, federal employees, and employees of small municipalities are generally exempt.

Coverage: Workers’ comp pays for medical bills and a portion of lost wages if an employee is injured or becomes ill due to work. The benefit amount is typically two-thirds of the employee’s average weekly wage, up to a state-mandated cap.

Penalties for Non-Compliance: Employers who fail to provide required coverage may face fines and legal action.

Commercial Auto Insurance Basics

Required for All Business-Owned Vehicles: Every vehicle owned or operated by an Alabama business must have commercial auto insurance.

Minimum Liability Coverage:

$25,000 for bodily injury per person

$50,000 for bodily injury per accident

$25,000 for property damage per accident

Additional Coverage: Businesses can add collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage for broader protection.

Personal Vehicles Used for Work: Hired and non-owned auto insurance (HNOA) is recommended if employees use personal or rented vehicles for business tasks, as personal auto policies usually exclude business use.

Professional Liability for Certain Jobs

Who Needs It: Any business or individual providing professional advice or services-such as consultants, healthcare providers, architects, engineers, accountants, lawyers, and IT professionals-faces professional liability risk.

Legal Requirements: While Alabama does not mandate professional liability insurance for most professions, healthcare practitioners and home inspectors must carry it; design professionals must disclose in writing if they do not have coverage.

Coverage: Professional liability insurance (also known as errors and omissions or E&O) protects against claims of negligence, mistakes, or failure to deliver professional services as promised, including legal defense costs and settlements.

Contractual Requirements: Many clients and contracts require proof of professional liability insurance before work begins.

Is General Liability Insurance Mandatory?

State Law: General liability insurance is not required by Alabama state law for most businesses, except for certain licensed professions such as home inspectors.

When It’s Needed:

Leases: Often required by landlords as a condition of renting commercial space.

Contracts: Many clients and contracts require proof of general liability coverage.

Licensing: Some professions, like home inspectors, require general liability insurance to maintain.

Why Carry It: General liability insurance protects against third-party bodily injury, property damage, and advertising injury claims. It is highly recommended for all businesses to mitigate common risks.

Other Useful Coverages for Businesses

Business Owner’s Policy (BOP): Bundles general liability and commercial property insurance for cost-effective, broad protection.

Commercial Property Insurance: Covers damage to buildings, inventory, equipment, and furniture.

Cyber Liability Insurance: Protects against data breaches and cyberattacks, covering notification costs, legal fees, and more.

Employment Practices Liability Insurance (EPLI): Covers claims related to wrongful termination, discrimination, and harassment.

Umbrella/Excess Liability Insurance: Provides additional coverage limits above standard liability policies.

Product Liability Insurance: Essential for manufacturers and retailers to cover claims related to product defects or harm.

Builder’s Risk Insurance: Covers construction projects against damage or loss during the build phase.

| Insurance Type | Required by Law? | Who Needs It? | Typical Minimums/Notes |

|---|---|---|---|

| Workers' Compensation | Yes (≥5 employees) | All with 5+ employees (including part-time, LLC) | Covers medical/wage benefits for work injuries |

| Commercial Auto Insurance | Yes (for business autos) | Any business-owned vehicle | $25k/$50k BI, $25k PD liability |

| General Liability | No (except some professions) | Highly recommended/all businesses | Often required by landlords/clients; mandatory for home inspectors |

| Professional Liability (E&O) | No (except some professions) | Service providers, required for some licenses | Mandatory for healthcare, home inspectors; contractually required in many fields |

| Commercial Property Insurance | No | Businesses with physical assets | Often bundled in BOP |

| Cyber Liability | No | Businesses handling sensitive data | Protects against cyber threats |

| EPLI | No | Businesses with employees | Covers HR-related claims |

| Umbrella/Excess Liability | No | Businesses seeking higher limits | Adds extra coverage above other policies |

| Builder’s Risk Insurance | No | Construction projects | Covers construction phase risks |

Protect your Alabama business by understanding and meeting these insurance requirements. Consult with a licensed Alabama insurance agent to ensure your coverage is tailored to your specific risks and industry needs.

Liberty Mutual vs Progressive

Compare coverage, pricing, and customer reviews for Liberty Mutual and Progressive to help you choose the right insurer.

Compare NowTravelers vs Progressive

See how Travelers and Progressive stack up on auto and home insurance, discounts, and claims service.

View ComparisonSafeco vs Progressive

Explore the differences between Safeco and Progressive for car insurance, coverage options, and more.

Learn MoreAmerican Family vs Progressive

Discover which insurer offers better value and service: American Family or Progressive.

See DetailsAmica vs Erie Insurance

Compare Amica and Erie Insurance on customer satisfaction, coverage, and pricing.

Compare PoliciesTravelers vs GEICO

Find out how Travelers and GEICO compare on rates, discounts, and claims experience.

Explore OptionsFAQs: Alabama Business Insurance

Blake Insurance Group

Phone: (888) 387-3687

Email: [email protected]

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464