Lemonade vs USAA

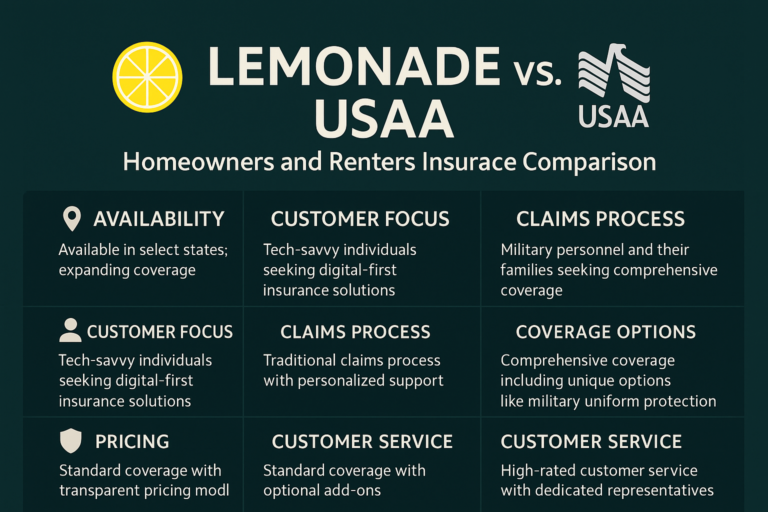

Lemonade and USAA are two of the most prominent names in renters insurance for 2025, but they cater to very different audiences and offer distinct advantages. This comparison explores their backgrounds, coverage, pricing, customer experience, and more to help you decide which is the best fit for your needs.

START FREE ONLINE QUOTE NOW

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold

Overview and Company Background

Lemonade

Founded in 2015 in New York City, Lemonade is a tech-driven insurance company focused on providing affordable, user-friendly insurance products. It leverages artificial intelligence for fast quotes, claims, and a seamless digital experience, targeting younger, tech-savvy renters.

USAA

USAA (United Services Automobile Association) was established in 1922 to serve military members and their families. Headquartered in San Antonio, USAA is a member-owned organization renowned for its comprehensive insurance and financial services, available exclusively to active duty military, veterans, and their families

Coverage Options

| Feature | Lemonade | USAA |

|---|---|---|

| Personal Property | Replacement cost coverage | Replacement cost coverage |

| Personal Liability | Standard | Standard |

| Loss of Use | Included | Included |

| Medical Payments | Included | Included |

| Flood/Earthquake | Not standard | Included in standard policy |

| Military Gear | Not applicable | Covered, including overseas |

Optional Add-ons and Endorsements

Lemonade:

- Extra Coverage: High-value items like jewelry, art, and electronics.

- Water Backup: Damage from drain/sewer backups.

- Equipment Breakdown: Appliance/electronic failures.

USAA:

- Valuable Personal Property: Higher limits, no deductible.

- Extra Electronic Coverage: Accidental electronic damage.

- Personal Cyber Insurance: Digital threat protection.

Pricing and Discounts

| Company | Average Monthly Premium | Discounts Available |

|---|---|---|

| Lemonade | $16 (starting at $5) | Bundling, security devices |

| USAA | $12 | Bundling, claims-free, security, military-specific |

Availability

- Lemonade: 29 states + D.C., expanding.

- USAA: All 50 states + overseas (for members).

- Eligibility: Lemonade - anyone in served states; USAA - military members, veterans, families.

Claims Process and Customer Experience

Lemonade: Fast AI app claims, 40% paid instantly. Human review for complex cases.

USAA: Online, app, and phone. Reliable but slower, highly rated service.

Customer Satisfaction and Complaints

Lemonade: More complaints than expected; praised for digital UX.

USAA: Fewer complaints; excellent customer service.

Pros and Cons

Lemonade Pros:

- Affordable

- Fast, app-based experience

- Giveback program

Lemonade Cons:

- Limited availability

- Fewer discounts

- High complaint ratio

USAA Pros:

- Flood and earthquake included

- Low premiums

- Outstanding reputation

USAA Cons:

- Military only

- Some add-ons needed

- No 24/7 service

Who Should Choose Which?

- Lemonade: Fast, affordable digital-first renters insurance for eligible states.

- USAA: Best for military community needing broad coverage and support.

Comparison Table

| Feature | Lemonade | USAA |

|---|---|---|

| Founded | 2015 | 1922 |

| Eligibility | Anyone (29 states + D.C.) | Military, veterans, families |

| Avg. Monthly Premium | $16 (from $5) | $12 |

| Standard Coverage | Basic (property, liability, loss) | Basic + flood & earthquake |

| Replacement Cost | Yes | Yes |

| Flood/Earthquake | No (add-on) | Yes (included) |

| High-Value Endorsements | Yes | Yes |

| Tech | App, AI-based | Online & traditional |

| Claims | Instant for many | Reliable, slower |

| Discounts | Limited | Multiple + military |

| Availability | 29 states + D.C. | Nationwide + overseas |

| Customer Satisfaction | Below average | Excellent |

| Complaint Rate | High | Low |

Summary

Lemonade excels in affordability and digital convenience, making it a top pick for renters who want a fast, app-based experience and live in eligible states. USAA, on the other hand, is unmatched for military families, offering robust standard coverage (including flood and earthquake) at some of the lowest prices, with industry-leading customer satisfaction. Your eligibility and personal preferences will ultimately determine which insurer is the better fit for your renters insurance needs in 2025.

Compare Insurance Quotes Instantly

Get personalized rates in minutes from trusted providers. No hidden fees or commitments.

Get Your Free QuoteHome Insurance in Texas

Explore tailored home insurance options for Texas residents. Get coverage that fits your needs and budget.

Learn MoreHomeowners Insurance

Protect your home and belongings with comprehensive homeowners insurance. Compare policies and find your best fit.

Get StartedHome Insurance Agency

Connect with a trusted home insurance agency for expert advice and personalized service.

Contact UsHome Insurance Calculator

Estimate your home insurance costs with our easy-to-use calculator. Plan your coverage with confidence.

Calculate NowProgressive Insurance Claims (Ohio)

File and manage your Progressive insurance claims in Ohio quickly and efficiently.

File a ClaimFlood Insurance Quote (New Mexico)

Get a fast, free quote for flood insurance in New Mexico and protect your property from unexpected water damage.

Get a QuoteFrequently Asked Questions (FAQs): Lemonade & USAA Renters Insurance 2025

Lemonade Renters Insurance FAQs

How are Lemonade’s renters insurance premiums calculated?

Premiums depend on factors like your coverage amounts, deductible, location, security devices, and your credit and claims history.

What does a standard Lemonade renters policy cover?

It covers personal property (replacement cost), personal liability, loss of use (additional living expenses), and guest medical payments.

Can I add extra coverage for valuables?

Yes, Lemonade offers “Extra Coverage” for items like jewelry, art, and electronics.

Are there discounts available?

Lemonade offers limited discounts, mainly for bundling with other Lemonade policies and for having security devices like deadbolts or smoke detectors.

How do I file a claim?

Claims can be filed through the Lemonade app, with many processed and paid out in minutes.

Can I cancel my policy at any time?

Yes, you can cancel via the app or website and receive a refund for any unused premium.

Does Lemonade cover roommates?

Yes, you can share a Lemonade policy with a significant other, even if you’re not married.

USAA Renters Insurance FAQs

Who is eligible for USAA renters insurance?

USAA is available only to active-duty military, veterans, and eligible family members.

What does USAA renters insurance cover?

Standard coverage includes personal property (replacement cost), personal liability, loss of use, medical payments, and uniquely, flood and earthquake coverage.

Are there optional add-ons?

Yes, you can add coverage for electronics, valuable personal property, and personal cyber insurance.

How much does USAA renters insurance cost?

The average cost is about $12–$18 per month, depending on your location and coverage needs.

What discounts does USAA offer?

Discounts are available for bundling with auto policies, claims-free status, security systems, living on base, and attending military colleges.

How do I file a claim?

Claims can be filed online or through the USAA mobile app. You’ll need to provide evidence and details about your loss.

Is there a deductible?

Most claims have a deductible, but there is no deductible for certain coverages like military uniforms, valuable personal property, or cyber insurance.

Does USAA cover belongings overseas?

Yes, coverage extends to belongings if you’re deployed or living outside the U.S..

How is USAA rated for customer satisfaction?

USAA receives fewer complaints than average and is highly rated for customer satisfaction in industry studies.

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed