epremium Vs lemonade renters

ePremium vs. Lemonade Renters Insurance 2025: A Comprehensive Comparison

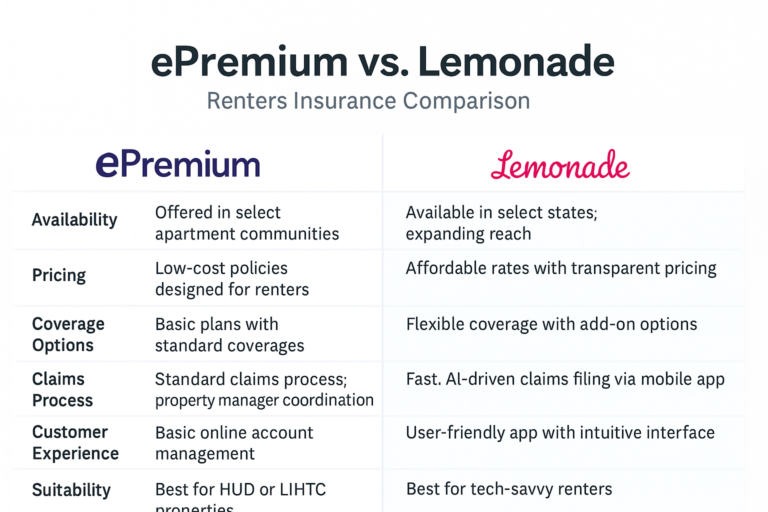

Renters insurance is a crucial safeguard for tenants, protecting personal belongings and providing liability coverage. Two notable providers in 2025 are ePremium and Lemonade, each catering to different renter needs and preferences. Here’s an in-depth comparison across key aspects

START FREE ONLINE QUOTE NOW

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold

Overview and Company Background

ePremium

ePremium is a licensed insurance agency specializing in renters insurance for multifamily and single-family rental properties. It partners with property management companies nationwide, offering tailored solutions and enhanced coverage options. Policies are typically underwritten by third-party insurers, and ePremium is available in all states except Alask.

Lemonade

Lemonade is a tech-driven insurer known for its fast, AI-powered platform and digital-first approach. Founded in 2015, Lemonade offers renters, homeowners, pet, and life insurance, with a strong emphasis on affordability, transparency, and social impact through its Giveback program. Lemonade operates in 28 states and Washington,

📦 Coverage Options

ePremium

Standard policies include:

Personal property coverage

Liability protection

Loss of use coverage

Medical payments to others

Lemonade

Standard coverage includes:

Replacement cost personal property

Personal liability

Loss of use (temporary living expenses)

Guest medical payments

➕ Optional Add-ons and Endorsements

ePremium offers:

Pet damage liability

Bed bug remediation

Identity theft protection

Water backup

Earthquake coverage (varies by state)

Lemonade offers:

Extra coverage for high-value items (jewelry, electronics, art)

Water backup coverage

Earthquake coverage in select locations

💵 Pricing and Discounts

ePremium

Average premium: $11–$22/month

Discounts are minimal but may include a pay-in-full discount

No credit check required, ideal for renters with limited credit history

Lemonade

Starting premium as low as $5/month

Offers discounts for bundling with other Lemonade products and using home safety devices

Credit may influence pricing depending on the state

🌎 Availability

ePremium

Available nationwide but typically offered through specific rental communities and property managers.

Lemonade

Available in 29 states plus Washington, D.C., with ongoing expansion efforts.

🛠 Claims Process and Customer Experience

ePremium

Claims must be filed by phone

Adjusters are usually assigned within 72 business hours

Customer service is available on weekdays with limited language support

Lemonade

Claims can be filed through the app or website

About 40% of claims are resolved instantly via AI

Customer service is primarily handled digitally

😊 Customer Satisfaction and Complaints

ePremium

Mixed reviews, particularly around billing and cancellations

Not BBB-accredited but holds an A- rating

Limited online policy management options

Lemonade

Generally receives positive reviews for speed and ease of use

Some complaints regarding denied claims and limited live support

BBB accredited with a B+ rating

✅ Pros and Cons

ePremium Pros

No credit check required

Unique apartment-related coverages

Available through many property management partners

ePremium Cons

Limited discounts

Claims process is slower and manual

Service tied to participating properties

Lemonade Pros

Affordable and transparent pricing

Fast, AI-powered claims experience

Seamless mobile app experience

Charitable Giveback program

Lemonade Cons

Not available in all states

Limited personal customer service

Higher-than-average complaints for a tech company

🎯 Who Should Choose Which?

Choose ePremium if:

You’re renting from a property that requires or recommends ePremium

You need coverages like bed bug remediation or pet damage

You want a policy without a credit check

Choose Lemonade if:

You prefer a fast and fully digital insurance experience

You want affordable premiums and app-based convenience

You like supporting social causes through insurance

📊 ePremium vs Lemonade Renters Insurance Comparison Table (2025)

| Feature | ePremium | Lemonade |

|---|---|---|

| Founded | 2005 | 2015 |

| Availability | Nationwide (via property partnerships) | 29 states + D.C. |

| Starting Premium | $11–$22/month | As low as $5/month |

| Standard Coverages | Personal property, liability, loss of use, medical payments | Personal property, liability, loss of use, medical payments |

| Optional Coverages | Pet damage, bed bug, ID theft, water backup, earthquake | Extra coverage, water backup, earthquake |

| Discounts | Limited; pay-in-full | Bundling, safety devices |

| Claims Process | Phone-based; adjuster within 72 hrs | App-based; AI-driven, instant in many cases |

| Customer Support | Phone (Mon–Fri, 8am–8pm ET) | Digital only (chat, email) |

| BBB Rating | A- (not accredited) | B+ (accredited) |

| Best For | Renters needing specific coverage or no credit check | Tech-savvy renters looking for speed & affordability |

Summary: Both ePremium and Lemonade are solid renters insurance options in 2025, depending on your priorities. If your apartment community offers ePremium, it might be the most convenient choice. If you’re looking for fast, affordable coverage with digital convenience, Lemonade is an excellent option.

Compare Insurance Quotes Instantly

Get personalized rates in minutes from trusted providers. No hidden fees or commitments.

Get Your Free QuoteePremium vs. Lemonade Renters Insurance 2025: Frequently Asked Questions

What types of coverage does ePremium offer?

ePremium policies generally include personal property, liability, loss of use, and medical payments to others. Some policies also offer replacement cost coverage and unique add-ons like pet damage and bed bug remediation.

Can I buy ePremium renters insurance directly as a tenant?

No, ePremium partners with landlords and property managers to offer renters insurance. Tenants typically access policies through their rental community or landlord.

What optional coverages are available with ePremium?

Optional add-ons include bed bug remediation, biohazard cleanup, pet damage, resident-caused water damage, and more. Availability may vary by policy.

How much does ePremium renters insurance cost?

The average policy ranges from $11 to $22 per month, depending on factors like location, coverage level, and the specific insurer underwriting the policy.

Does ePremium offer any discounts?

Yes, but discounts depend on the insurer. Common discounts include bundling, claims-free, auto-pay, and pay-in-full discounts.

What is eDeposit from ePremium?

eDeposit is a security deposit alternative. Tenants pay a one-time, nonrefundable fee, usually less than a traditional deposit, but the fee is not refundable.

How do I cancel my ePremium policy?

You can cancel online via the ePremium website. If you cancel mid-term, you may qualify for a refund for the unused portion of your policy.

How do I contact ePremium customer service?

Call 1 (800) 319-1390, Monday through Friday, 8 a.m. to 5 p.m. Eastern Time.

What does Lemonade renters insurance cover?

Lemonade covers personal property (for theft, fire, vandalism, and some water damage), personal liability, loss of use (temporary living expenses), and medical payments to others.

How quickly can I get covered and file a claim with Lemonade?

You can get a policy in about 90 seconds, and many claims are processed and paid within minutes thanks to Lemonade’s AI-driven platform.

How is Lemonade’s pricing determined?

Premiums are personalized based on coverage amounts, deductible, location, claims history, credit, and protective devices in your home.

Can I adjust my Lemonade policy or coverage?

Yes. You can easily adjust coverage amounts and add extra protection for valuables through the Lemonade app or website.

How do I cancel my Lemonade policy?

You can cancel anytime via the Lemonade app or website, and you’ll receive a refund for the unused portion of your premium.

Does Lemonade offer any discounts?

Discounts may apply for bundling policies, paying annually, or having security devices in your home.

What is Lemonade’s Giveback program?

Lemonade donates leftover premiums to charities chosen by policyholders at the end of each year, after paying claims and expenses.

Does Lemonade check credit or claims history?

Yes, but these are only two of many factors used to determine your rate, and their impact depends on state laws.

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed