cancel state farm auto insurance

Canceling an auto insurance policy can seem daunting, but as an independent insurance agent with Blake Insurance Group, I’m here to guide you through the process.

Canceling an auto insurance policy can seem daunting, but as an independent insurance agent with Blake Insurance Group, I’m here to guide you through the process.

Whether you’re in Arizona, Alabama, Florida, Georgia, New Mexico, New York, North Carolina, Oklahoma, Ohio, Texas, or Virginia, understanding the steps involved in canceling your State Farm auto insurance is crucial.

You might consider making a change for many reasons—perhaps you’re seeking more affordable rates, better customer service, or simply a policy that better fits your current needs. Whatever your reason, it’s essential to navigate the cancellation process carefully to ensure a smooth transition and avoid any lapses in coverage.

Let’s explore what you need to know to make an informed decision about your auto insurance.

Check Your Local Rates Now

Compare options from multiple Insurance companies

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold.

Understanding State Farm's Cancellation Policy

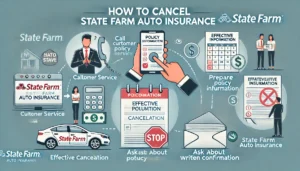

Three primary methods to cancel a State Farm auto insurance policy are by phone, mail, and in person. Here’s a detailed explanation of each method:

**Cancellation Methods**

– **By Phone**: The most straightforward way to cancel your State Farm auto insurance is by calling 1-800-STATEFARM (1-800-782-8332). This method allows for immediate cancellation or scheduling for a future date. When calling, you must provide your policy number, name, and date of birth. If you’ve sold your vehicle, you may also need to provide documentation such as a bill of sale or proof of plate forfeiture.

– **By Mail**: To cancel by mail, write a cancellation letter including your name, address, phone number, policy number, and the desired cancellation date. If switching providers, include the new insurer’s details. If applicable, attach any required documents like a bill of sale. Send this letter at least two weeks before the intended cancellation date to allow time for processing. The address for mailing is State Farm Insurance, One State Farm Plaza, Bloomington, IL 61710.

– **In Person**: Visit your local State Farm agent to cancel in person. Bring along your contact information and policy details. If you have sold your vehicle, bring proof such as a bill of sale or evidence of plate forfeiture. This method can also provide immediate cancellation.

**Required Information**

When canceling your policy through any of these methods, you will need to provide:

– Your policy number

– Your full name

– Your date of birth

– Any necessary documentation if you’ve sold your vehicle (e.g., bill of sale or proof of plate forfeiture)

**No Online Cancellations**

State Farm does not allow policy cancellations to be processed online. You must use one of the above methods to cancel your auto insurance policy.

Steps to Take Before Canceling

– **Review Current Policy**: Carefully examine your existing auto insurance policy to identify inaccuracies or overlooked discounts. This review can help you fully understand your coverage benefits and costs. Sometimes, adjusting your existing policy might better meet your needs than switching providers.

– **Avoid Coverage Gaps**: One of the most critical steps is securing a new insurance policy before canceling your current one. A lapse in coverage, even for a short period, can lead to fines, legal issues, or higher premiums in the future. Make sure your new policy is active before you finalize the cancellation of your State Farm policy.

– **Check for Refunds**: If you have prepaid your premiums, you might be eligible for a prorated refund upon cancellation. Contact State Farm to inquire about any potential refunds and ensure you understand how they will be processed. This step can help you recover any unused portion of your premium payment.

By taking these steps, you can minimize disruptions and financial risks associated with changing your auto insurance provider.

Reasons for Canceling State Farm Auto Insurance

– **Cost Considerations**: Rising premiums are a significant concern for many policyholders. In recent years, auto insurance rates have increased substantially, with a reported 26% rise across the U.S. in 2024 alone. This increase can take a larger portion of a driver’s income, prompting many to seek more affordable options. By comparing quotes from multiple insurers, clients can potentially find better rates that suit their budget. Shopping around is crucial as different insurers have varying pricing strategies, and what might be expensive with one company could be more affordable with another.

– **Customer Experience**: Dissatisfaction with customer service or claims handling can also drive clients to switch insurers. Issues such as delays in claims processing or perceived unfair practices can lead to frustration and a desire for better service. It’s important for clients to feel supported and valued by their insurer, and poor experiences can lead them to explore alternatives that offer higher satisfaction levels.

– **Life Changes**: Significant life events often necessitate changes in insurance coverage. For instance, moving to a different state might require a new policy due to differing state regulations and insurance requirements. Additionally, selling a vehicle is another common reason for canceling an auto insurance policy, as the coverage is no longer needed once the vehicle is no longer owned. These life changes prompt clients to reassess their insurance needs and make adjustments accordingly.

Alternatives to Canceling

– **Adjusting Coverage**: One way to potentially lower your premiums is by reviewing and adjusting your current coverage options or deductibles. For instance, increasing your deductible can reduce your monthly premium, though it means you’ll pay more out of pocket in the event of a claim. Additionally, you might find that you have coverage options that are no longer necessary or can be adjusted to fit your current needs better. Discussing these options with your State Farm agent can help tailor your policy to be more cost-effective while still providing the protection you need.

– **Bundling Discounts**: If you have multiple policies with State Farm, such as home and auto insurance, canceling one could affect the discounts you receive for bundling these policies. Bundling typically offers a significant discount, which means that removing one policy might increase the cost of the remaining ones. Before canceling, evaluate the overall cost impact on all your bundled policies. Sometimes, maintaining the bundle or even adding another type of insurance might provide better savings than canceling outright.

These alternatives can help you manage costs and maintain adequate coverage without a complete cancellation, ensuring you continue to benefit from any existing discounts and tailored coverage options.

FAQs on Canceling State Farm Auto Insurance

Can I cancel my State Farm auto insurance at any time?

Yes, you can cancel your State Farm auto insurance policy at any time. However, the easiest way to do so is on your policy renewal date to avoid coverage gaps and align the dates with a new policy if you're switching insurers.

Does State Farm charge a cancellation fee?

State Farm generally does not charge a cancellation fee. However, it is recommended to check your specific policy documents or contact State Farm directly to confirm this, as policies may vary.

Will I receive a refund if I cancel my policy before the term ends?

If you have prepaid your premiums, you may be eligible for a prorated refund for the unused portion of your coverage after canceling your policy.

Can I cancel my State Farm auto insurance online?

No, State Farm does not offer an online option for canceling auto insurance policies. You can cancel by phone, by mail, or in person at a local agent's office.

What happens if I stop paying my State Farm premiums without formally canceling?

If you stop paying your premiums, State Farm will eventually cancel your policy after applying any unused premiums. However, this is not recommended due to potential coverage gaps and legal implications.

Do I need a new insurance policy before canceling my current one with State Farm?

Yes, it is crucial to have a new auto insurance policy in place before canceling your current one to avoid any lapses in coverage, which could lead to fines or higher premiums in the future.

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464