Renters Insurance Arizona: Protecting Your Belongings with Peace of Mind

As an independent insurance agent in Arizona, I understand the unique needs and concerns of renters in our state. Renters insurance is a crucial tool that can protect your belongings and financial well-being, yet it’s often misunderstood or overlooked.

This article aims to demystify renters insurance, providing a comprehensive understanding of what it is, why it’s essential, and how to choose the best policy for your needs. We’ll explore Arizona’s requirements for renters insurance, the types of coverage available, and the average cost.

Do You Need Renters Insurance in Arizona?

Short Answer: Yes, you do. Renters insurance is highly recommended for anyone living in Arizona. While it may not be legally required, many apartment complexes and landlords require tenants to carry renters insurance.

This requirement ensures that the tenant and the property owner are protected in case of accidents or damages caused by the tenant’s negligence. Even if it is not mandatory, having renters insurance is an intelligent decision to safeguard your belongings and mitigate potential liability risks.

Check Your Local Rates Now

Compare options from multiple Insurance companies

At Blake Insurance Group, we respect your privacy. Your personal information is used solely for quote purposes and is not shared or sold.

Customer Reviews

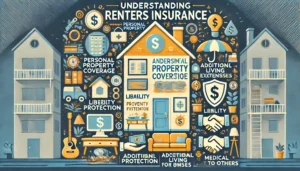

Understanding Renters Insurance

Renters insurance, also known as tenants’ insurance, is a policy that provides some of the benefits of homeowners’ insurance but does not include coverage for the dwelling or structure, except for slight alterations that a tenant makes to the structure. It protects renters against unexpected events, often called covered perils, such as theft, a break-in, or a visitor’s injury.

Renters insurance, also known as tenants’ insurance, is a policy that provides some of the benefits of homeowners’ insurance but does not include coverage for the dwelling or structure, except for slight alterations that a tenant makes to the structure. It protects renters against unexpected events, often called covered perils, such as theft, a break-in, or a visitor’s injury.

One of the primary aspects of renters insurance is the protection it offers for your personal belongings. This includes clothing, furniture, electronics, and other personal property. The policy covers these items against named perils such as fire, theft, and vandalism. For instance, if a fire destroys your furniture and clothing, renters insurance may help you pay to replace them.

It’s important to note that the landlord’s insurance policy typically covers the building itself, but it may not include your personal belongings or cover injuries sustained within the structure. Renters insurance fills the gap and ensures that your personal property is covered in case of unexpected circumstances.

Another crucial aspect of renters insurance is the liability coverage it provides. If someone is injured in your rented home or apartment, they could sue you. Renters insurance can help cover legal expenses and even judgments against you. This liability protection extends to situations where you might accidentally damage someone else’s property.

In addition to personal property and liability coverage, renters insurance includes a provision known as ‘loss of use’ or ‘additional living expense’ coverage. Suppose your rental home or apartment becomes uninhabitable due to a covered peril, such as a fire or severe damage. In that case, your renter’s insurance policy may cover the additional expenses you’ll incur during that time. This could include costs like hotel bills and meals.

Renters Insurance Requirements in Arizona

Renters insurance is not mandated by law in Arizona. However, landlords or apartment buildings may require it as a condition of moving in. While a landlord’s insurance policy typically covers the building itself, it does not usually extend to the tenant’s personal belongings or injuries within the rented property.

Landlords may require renters insurance for several reasons. Firstly, it can help lower their insurance premiums. Secondly, it can protect both the landlord and the tenant in case of unexpected events, such as a fire or theft. For instance, if a tenant accidentally causes a fire that damages the building, the landlord’s property is protected because the tenant’s renters insurance may cover the damage.

Moreover, requiring renters insurance can also help landlords select tenants. In competitive rental markets, landlords may receive numerous applications for a single unit. By requiring renters insurance, they can narrow down their selection to the most responsible applicants.

Types of Coverage in Renters Insurance Policies in Arizona

Renters insurance in Arizona provides a safety net for individuals renting a home or apartment, offering various types of coverage to protect against financial loss. Here are the critical coverages included in a standard renters insurance policy:

Personal Property Protection

This coverage is essential for safeguarding your belongings, such as furniture, electronics, clothing, and other personal items. If your possessions are damaged or lost due to covered perils like fire, theft, or vandalism, personal property protection can help pay for the cost of repair or replacement.

Liability Coverage

Liability coverage is a critical component of renters insurance that protects you if someone is injured on your property or if you accidentally cause damage to someone else’s property. It can cover legal expenses and any judgments or settlements up to the policy’s limit.

Loss of Use Coverage

Also known as additional living expenses, loss of use coverage comes into play if your rental unit becomes uninhabitable due to a covered loss, such as a fire or severe storm damage. It can help pay for temporary housing and other increased living expenses while your rental is being repaired.

Optional Coverages

Renters insurance policies can also include optional coverages for additional protection:

– **Identity Theft Protection**: This coverage helps to cover the costs associated with recovering from identity theft, such as legal fees and lost wages.

– **Scheduled Personal Property Endorsement**: For high-value items that exceed the standard policy limits, such as jewelry or expensive electronics, you can add specific coverage to ensure they are fully protected.

– **Travel Protection**: Some policies cover personal belongings and other travel protections.

Renters need to review their policy details and consider these optional coverages based on their individual needs and the value of their possessions. Consulting with an insurance agent can help ensure you have the most comprehensive protection possible.

Cost of Renters Insurance in Arizona

The cost of renters insurance in Arizona varies, but on average, it ranges from $103 to $221 per year. The state average cost of renters insurance is $167 per year, which is lower than the national average of $180 per year. Other sources suggest that the average cost of renters insurance in Arizona is around $147 per year, or roughly $12 per month, while some suggest it’s $18 per month, or $211 per year. These variations in average cost are due to the different factors influencing the price of renters insurance.

Factors Affecting the Cost

Several factors can affect the cost of renters insurance in Arizona:

**Coverage Limits**: The more coverage you want your renters insurance to provide, the more you have to pay.

**Deductible**: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually means a lower premium, and vice versa.

**Location**: The location of your rental property can significantly impact the cost of your renters insurance. Factors such as the crime rate, the weather and climate, and the age and condition of your property can all affect the cost.

**Personal Property Value**: The value of your personal belongings can also influence the cost of your renters insurance. If you have many valuable possessions, you’ll likely pay more for your insurance.

**Insurance Company**: Different insurance companies offer different rates. Getting multiple quotes to ensure you get the best deal is always a good idea.

It’s important to note that these are average rates, and premium costs may differ. For example, USAA offers affordable renters insurance in Arizona at an average annual rate of $124, followed by State Farm and American Family. However, carriers’ prices vary significantly, so getting multiple quotes is wise.

Rental Insurance Costs in Arizona Cities

| City | Estimated Annual Cost |

|---|---|

| Phoenix | $221 |

| Tucson | $103 |

| Mesa | $180 |

| Chandler | $195 |

| Gilbert | $200 |

| Glendale | $185 |

| Scottsdale | $210 |

| Peoria | $175 |

| Tempe | $190 |

| Surprise | $165 |

| San Tan Valley | $160 |

| Goodyear | $170 |

| Yuma | $120 |

| Buckeye | $155 |

| Avondale | $165 |

| Flagstaff | $145 |

| Casas Adobes | $150 |

| Queen Creek | $160 |

| Maricopa | $135 |

| Lake Havasu City | $125 |

| Casa Grande | $130 |

How to File a Renters Insurance Claim

Filing a renters insurance claim involves several steps, which include reporting the incident, documenting the damages or losses, and cooperating with the insurance company during the claims process.

When to File a Claim

You should file a renters insurance claim when the cost of your damaged or lost personal property exceeds your deductible. Common scenarios that may necessitate filing a claim include burglary, fire damage, water damage, or injury to a guest. However, if you’ve filed a claim recently or your damaged or lost property is less than your deductible, it may not be worth filing a claim.

Reporting Damages or Losses

The first step in filing a claim is to report the incident. If the event involves theft, burglary, or vandalism, you should file a police report. You should also notify your landlord about any damages or losses, as they may be responsible for repairing certain damages to the unit.

Documenting the Incident and Losses

Documentation is key in the claims process. You should take notes and pictures of the damage and gather any receipts or other proof of ownership for the damaged or lost items. If you cannot provide proof of ownership and loss, the insurer may deny your claim or pay less than your claim is worth.

Contacting Your Insurance Company

After documenting the incident and losses, you should contact your insurance company as soon as possible to start the claim process. You can call your insurance company or submit a claim online or through the company’s app if available. When contacting your insurance company, provide all your information about the incident, including the police report if applicable.

The Claims Process

Once you’ve reported the claim and provided all the necessary information, the insurance company will begin the claims process. This typically involves reviewing and investigating the claim, assessing the damage, and requesting documents. The insurance company may send a claims adjuster to inspect the damage, especially for items with a higher value.

After the investigation, the insurance company will either approve or deny the claim. If the claim is approved, the company will provide payment or authorize repairs. The amount of time it takes to process a claim can vary depending on the extent of the damages or losses.

What to Expect After Filing a Claim

In most cases, your insurance premiums will increase after filing a renters insurance claim. However, the increase is usually slight and may only amount to a few monthly dollars. If your claim is denied, it’s essential to understand why and determine if there are any steps you can take to appeal the decision.

Comparison of Renters Insurance Companies in Arizona

| Company | Average Cost (Annual) | Coverage Options | Customer Satisfaction (J.D. Power) |

|---|---|---|---|

| Lemonade | $90 | Personal property, liability, loss of use, medical payments, additional endorsements | 854/1000 |

| Auto-Owners | $136 | Personal property, liability, medical payments, additional living expenses, optional Renters Plus | High satisfaction, low complaints |

| Commonwealth | $147 | Personal property, liability, medical payments, additional living expenses, optional coverages | Positive local reviews |

| Hallmark | $162 | Personal property, liability, medical payments, additional living expenses, optional coverages | A+ BBB rating |

| Nationwide | $163 | Personal property, liability, medical payments, additional living expenses, optional coverages | High satisfaction |

| Progressive | $144 | Personal property, liability, loss of use, medical payments, additional endorsements | High satisfaction |

| Liberty Mutual | $60 | Personal property, liability, medical payments, additional living expenses, optional coverages | High satisfaction |

| USAA | $143 | Personal property, liability, medical payments, additional living expenses, earthquake coverage | Top-rated, exclusive to military |

| State Farm | $126 | Personal property, liability, medical payments, additional living expenses, optional coverages | High satisfaction |

| American Family | $121 | Personal property, liability, medical payments, additional living expenses, optional coverages | High satisfaction |

| Farmers Insurance | $127 | Personal property, liability, medical payments, additional living expenses, optional coverages | High satisfaction |

2024 Top Renters insurance companies in AZ

**Lemonade**: Lemonade is a technology-driven insurance company that offers affordable renters insurance policies. With an average cost of $14 per month nationwide, Lemonade provides coverage for personal property, personal liability, and loss of use.

**Lemonade**: Lemonade is a technology-driven insurance company that offers affordable renters insurance policies. With an average cost of $14 per month nationwide, Lemonade provides coverage for personal property, personal liability, and loss of use.

One of Lemonade’s critical features is its user-friendly app, which allows customers to customize and manage their policies easily. Lemonade aims to provide its customers with a seamless and efficient insurance experience by leveraging technology and a unique business model.

**Auto-Owners**: Auto-Owners Insurance offers renters insurance policies with various discounts and coverages tailored to individual needs. Their policies cover personal property, additional living expenses, and personal liability. The average cost of Auto-Owners renters insurance is $136 per year or $11 per month.

**Auto-Owners**: Auto-Owners Insurance offers renters insurance policies with various discounts and coverages tailored to individual needs. Their policies cover personal property, additional living expenses, and personal liability. The average cost of Auto-Owners renters insurance is $136 per year or $11 per month.

One of the optional coverages offered by Auto-Owners is Renters Plus, which covers refrigerated products, water back-up of sewers or drains, waterbed liability coverage, and waives the glass deductible. For example, if you lose power and a refrigerator full of food spoils, you’re covered for up to $750.

Auto-Owners Insurance provides several discounts to help customers save on their policies. Some discounts include multi-policy discounts, good student discounts, paid-in-full discounts, and green discounts for enrolling in paperless billing and paying policy premiums online. It’s important to note that rates and discounts vary based on location, coverage amounts, and individual circumstances.

![]() **Commonwealth Casualty**: Commonwealth Casualty is an insurance company that offers renters insurance with various coverages tailored to individual needs. Their policies include liability coverage for property damage and lawsuits, personal property coverage, loss of use, and personal property replacement costs. They also provide a multi-policy discount for bundling different insurance products, such as combining car and renters insurance.

**Commonwealth Casualty**: Commonwealth Casualty is an insurance company that offers renters insurance with various coverages tailored to individual needs. Their policies include liability coverage for property damage and lawsuits, personal property coverage, loss of use, and personal property replacement costs. They also provide a multi-policy discount for bundling different insurance products, such as combining car and renters insurance.

Commonwealth Casualty’s renters insurance policies protect policyholders against financial losses due to theft, damage, or destruction of personal property and liability claims arising from injuries or property damage caused to others. The company is committed to providing its customers with affordable insurance products and services, focusing on customization and innovation.

It’s essential to compare quotes and policies from different companies to find the best fit for your needs. The average cost of renters insurance in Arizona is $167 per year, which is lower than the national average of $180 per year.

**Hallmark Insurance**: Hallmark Insurance is a personal lines carrier that offers renters insurance with competitive rates, affordable payment plans, and flexible coverage options. They provide coverage in several states, including Arizona, Arkansas, Colorado, Indiana, Kentucky, Montana, Nevada, New Mexico, Ohio, Oklahoma, Tennessee, and Texas. Hallmark’s renters insurance policies include coverage for personal property, additional living expenses, and personal liability.

**Hallmark Insurance**: Hallmark Insurance is a personal lines carrier that offers renters insurance with competitive rates, affordable payment plans, and flexible coverage options. They provide coverage in several states, including Arizona, Arkansas, Colorado, Indiana, Kentucky, Montana, Nevada, New Mexico, Ohio, Oklahoma, Tennessee, and Texas. Hallmark’s renters insurance policies include coverage for personal property, additional living expenses, and personal liability.

Some advantages of choosing Hallmark Insurance for renters insurance include an A+ BBB rating, a best-in-class quoting and policy administration system, full electronic signature capabilities, and client self-service options, including 24/7 online account access. They also offer various discounts, such as increased deductible, advanced quotes, multi-policy, and protective device discounts, although these may vary by state.

It’s essential to compare quotes and policies from different companies to find the best fit for your needs. The average cost of renters insurance in Arizona is $167 per year, which is lower than the national average of $180 per year.

**Nationwide Insurance**: Nationwide offers renters insurance in Arizona with various coverage options, pricing, endorsements, and unique benefits. Their standard renters’ insurance policies include coverage for personal belongings, personal liability, medical payments to others, building additions and alterations, and credit card coverage. Nationwide’s policies are available in 43 states, including Arizona.

**Nationwide Insurance**: Nationwide offers renters insurance in Arizona with various coverage options, pricing, endorsements, and unique benefits. Their standard renters’ insurance policies include coverage for personal belongings, personal liability, medical payments to others, building additions and alterations, and credit card coverage. Nationwide’s policies are available in 43 states, including Arizona.

Some of the unique benefits of Nationwide’s renters insurance include credit card coverage, which protects you from identity theft by covering unauthorized transactions on credit and debit cards and forged checks. Additionally, Nationwide offers building addition/alteration coverage at no extra cost, meaning you’re covered for any improvements you make to your rented home with your landlord’s permission.

Nationwide offers various discounts to help customers save on their policies, such as multi-policy discounts, protective device discounts, and claims-free discounts. The average cost of renters insurance in Arizona is $167 per year, which is lower than the national average of $180 per year.

**Progressive**: Progressive is a well-known insurance provider that offers renters insurance in Arizona with different coverage options and pricing to suit individual needs. Their standard renters insurance policies include coverage for personal property, loss of use, personal liability, and medical payments to others. The average cost of renters insurance through Progressive ranges from $14 to $30 per month, depending on your state, according to 2021 data from Progressive.

**Progressive**: Progressive is a well-known insurance provider that offers renters insurance in Arizona with different coverage options and pricing to suit individual needs. Their standard renters insurance policies include coverage for personal property, loss of use, personal liability, and medical payments to others. The average cost of renters insurance through Progressive ranges from $14 to $30 per month, depending on your state, according to 2021 data from Progressive.

Progressive offers discounts to help customers save on their policies, such as bundling renters and auto insurance, which can save an average of 3% on your auto policy. Other discounts may be available based on location, coverage amounts, and individual circumstances. It’s essential to compare quotes and policies from different companies to find the best fit for your needs. The average cost of renters insurance in Arizona is $167 per year, which is lower than the national average of $180 per year.

**Liberty Mutual**: Liberty Mutual offers renters insurance in Arizona with various coverage options, pricing, endorsements, and unique benefits. Their standard renter’s insurance policies include coverage for personal property, personal liability, medical payments to others, and loss of use. The average cost of Liberty Mutual’s renter’s insurance in Arizona is an affordable $15 per month, but the premium can be higher if you add optional coverages.

**Liberty Mutual**: Liberty Mutual offers renters insurance in Arizona with various coverage options, pricing, endorsements, and unique benefits. Their standard renter’s insurance policies include coverage for personal property, personal liability, medical payments to others, and loss of use. The average cost of Liberty Mutual’s renter’s insurance in Arizona is an affordable $15 per month, but the premium can be higher if you add optional coverages.

Liberty Mutual provides customizable quotes and policies to meet your needs, and they offer several discounts, such as multi-policy discounts. Their renters insurance is available in all 50 states, and they have four offices in the Phoenix area, including Scottsdale, Mesa, Litchfield Park, and Chandler.

Some optional coverages offered by Liberty Mutual include earthquake coverage, jewelry coverage, and identity theft coverage. It’s essential to compare quotes and policies from different companies to find the best fit for your needs. The average cost of renters insurance in Arizona is $167 per year, which is lower than the national average of $180 per year.

FAQs about Renters Insurance in Arizona

Is renters insurance required in Arizona?

No, renters insurance is not required by Arizona state law. However, some landlords may require tenants to carry renters insurance as a condition of the lease.

What does renters insurance cover in Arizona?

Renters insurance typically covers:

- Personal Property: Protection for your belongings against perils like fire, theft, and vandalism.

- Liability Coverage: Covers legal expenses and damages if you're found liable for injury to others or damage to their property.

- Additional Living Expenses (ALE): Covers costs like hotel stays if your rental unit becomes uninhabitable due to a covered peril.

- Medical Payments to Others: Covers medical expenses for guests injured on your property, regardless of fault.

How much does renters insurance cost in Arizona?

The average cost of renters insurance in Arizona is around $167 per year, but this can vary based on factors like location, coverage amount, and the insurance provider. Some of the cheapest options include USAA ($143 annually) and American Family ($121 annually).

How can I save money on renters insurance in Arizona?

- Bundle Policies: Combine renters insurance with other policies like auto insurance for discounts.

- Increase Deductibles: Opt for a higher deductible to lower your premium.

- Shop Around: Compare rates from multiple insurers to find the best deal.

- Discounts: Look for discounts offered for safety features like smoke detectors or security systems.

What factors affect the cost of renters insurance in Arizona?

Several factors influence the cost, including:

- Location: Crime rates and risk of natural disasters in your area.

- Coverage Amount: Higher coverage limits increase premiums.

- Deductibles: Higher deductibles typically result in lower premiums.

- Credit Score: Insurers may use your credit score to determine your rate.

Can I get renters insurance if I have a pet?

Yes, most renters insurance policies cover liability for pet-related damages or injuries. However, some insurers may have breed restrictions or charge higher premiums for certain types of pets.

How do I file a claim for renters insurance in Arizona?

To file a claim:

- Document the Damage: Take photos or videos of the damage.

- Report to the Police: If the loss is due to theft or vandalism, file a police report.

- Contact Your Insurer: Notify your insurance company as soon as possible and provide the necessary documentation.

- Follow Up: Keep in touch with your insurer to track the status of your claim.

Blake Nwosu

Owner & Principal Agent

Expertise: All personal and commercial line insurance, including auto, home, business, health, and life insurance.

License: 16117464

Blake Insurance Group

Phone: (888) 387-3687

Email: info@blakeinsurancegroup.com

Hours: Mon-Fri 9:00 am to 5:00 pm

Sat-Sun: Closed